Your Ultimate Guide to Saving Smartly

.

.

Making a significant purchase, whether it’s a new car, a home appliance, or a dream vacation, requires careful planning and budgeting.

By following a structured approach, you can make your dream purchase without compromising your financial stability.

Here’s a comprehensive guide to help you budget effectively for big purchases, ensuring you stay on track and make the most of your savings.

.

1. Determine the Total Cost

Before you start saving, it’s crucial to understand the full cost of your intended purchase. This involves more than just the sticker price.

Breakdown of Costs:

Base Price:

The initial cost of the item or service.

Taxes:

Calculate the sales tax or VAT applicable in your region. For instance, if you’re buying a car for $30,000 and your state has a 7% sales tax, you’ll need to add $2,100 to the base price.

Delivery Fees:

If the purchase requires delivery, include the cost of shipping or installation.

Additional Expenses:

Consider any additional costs like registration fees for a new car or setup fees for home appliances.

Example:

If you’re planning to buy a new refrigerator for $1,200, your total cost might include:

– Base Price: $1,200

– Sales Tax (8%): $96

– Delivery Fee: $50

– Total Cost: $1,346

.

Understanding the total cost helps you set a realistic savings goal and avoid surprises.

.

2. Set a Savings Goal

Once you know the total cost, break it down into manageable chunks.

Steps to Setting a Savings Goal:

Determine the Target Amount:

Use the total cost calculated in the previous step.

Set a Time Frame:

Decide when you want to make the purchase. For instance, if you want to buy a new laptop in six months, your time frame is six months.

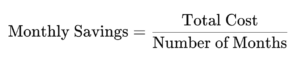

Calculate Monthly Savings:

Divide the total cost by the number of months in your time frame.

Using the refrigerator example, if you have 6 months to save $1,346, you’ll need to save approximately $224.33 each month.

Savings Formula:

Example:

For the refrigerator:

Setting a clear savings goal makes the process manageable and keeps you motivated.

.

.

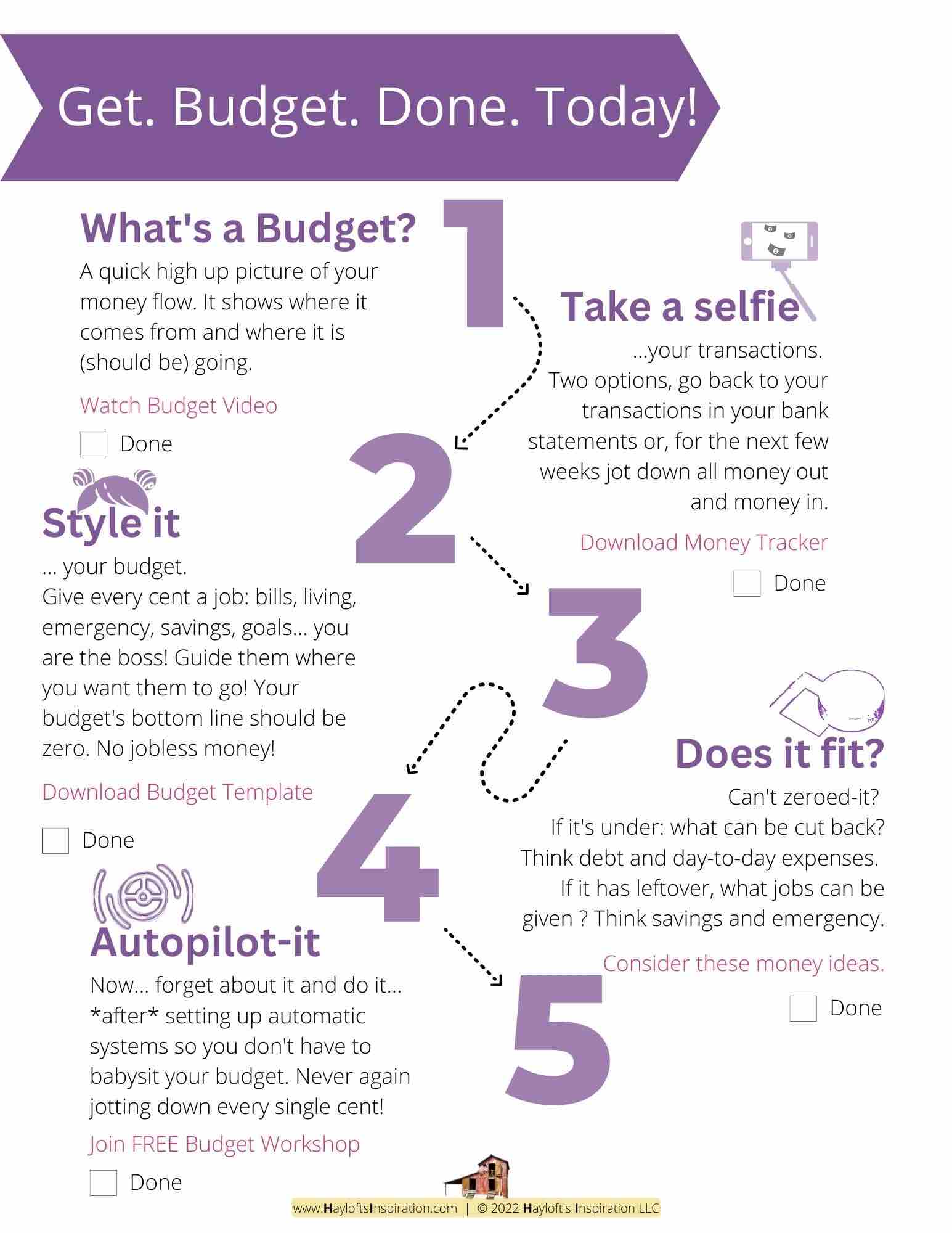

3. Cut Back on Non-Essentials

To reach your savings goal faster, consider reducing spending on non-essential items. This approach requires short-term sacrifices for long-term gains.

Tips for Cutting Back:

Review Your Budget:

Identify areas where you can reduce spending, such as dining out, entertainment, or subscriptions.

Set Temporary Limits:

Implement a temporary freeze on discretionary spending. For example, reduce dining out to once a month and use the extra money to boost your savings.

Track Your Spending:

Use a budgeting app or spreadsheet to monitor where your money is going and make adjustments as needed.

Example:

If you usually spend $200 a month on dining out, reducing this to $50 can free up an additional $150 monthly for your savings goal.

Cutting back on non-essentials can significantly impact your ability to save for big purchases.

.

4. Use Windfalls Wisely

Occasionally, you may receive unexpected money, such as bonuses, tax refunds, or gifts. Use these windfalls to accelerate your savings.

How to Use Windfalls:

Allocate to Savings:

Direct these extra funds straight into your savings account for the big purchase.

Avoid Temptation:

Resist the urge to spend windfalls on other non-essential items.

Example:

If you receive a $500 tax refund, deposit it into your savings fund. This can reduce the amount you need to save each month or shorten your savings period.

Using windfalls wisely can give your savings a significant boost and help you reach your goal faster.

.

.

.

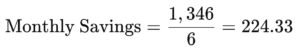

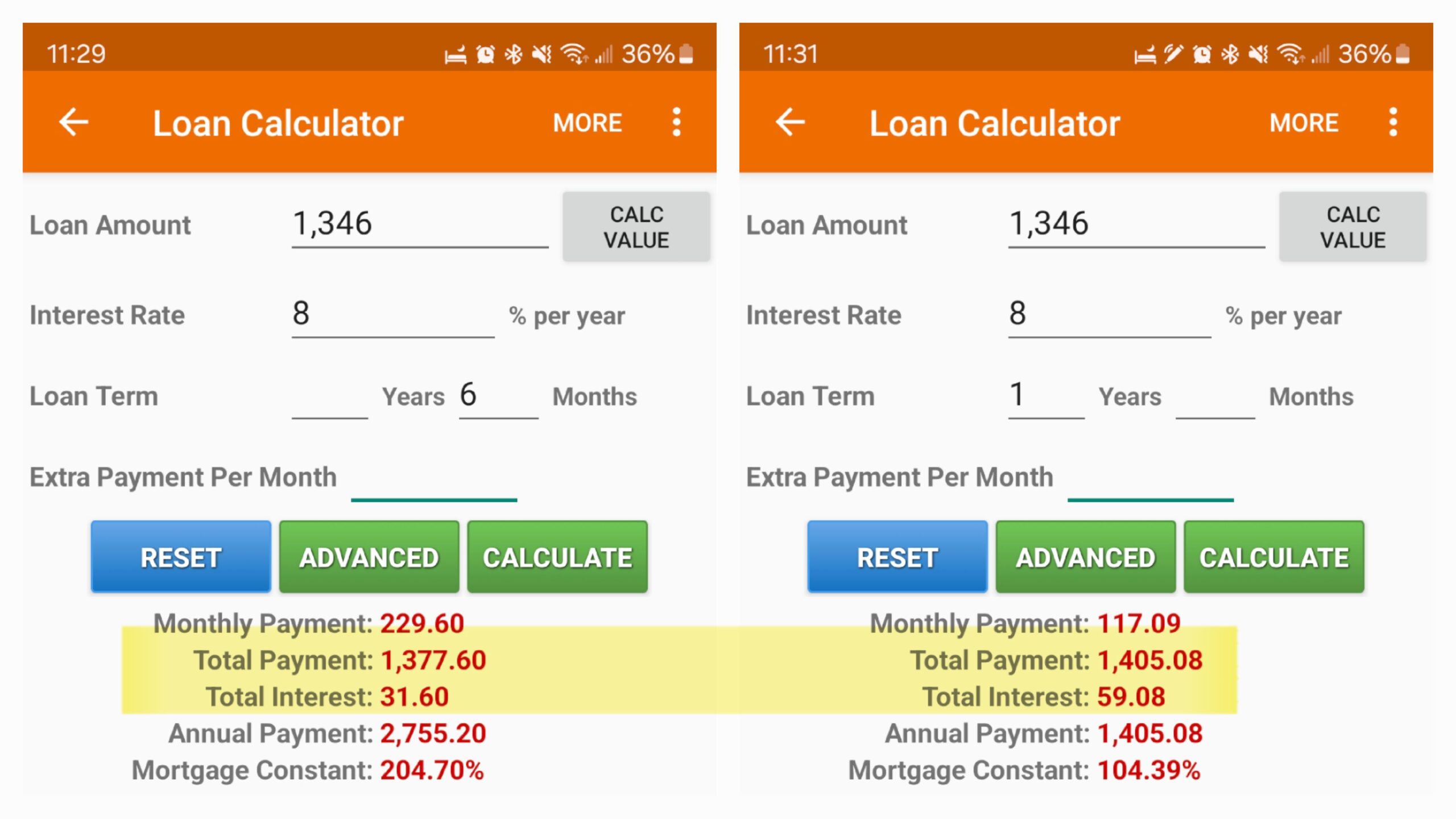

5. Consider Financing Options

If your savings aren’t quite enough, explore financing options. However, be cautious and mindful of interest rates and repayment terms.

Financing Considerations:

Interest Rates:

Compare rates from different lenders to find the best deal. Lower interest rates will reduce the overall cost of your purchase.

Repayment Terms:

Review the terms and conditions of the financing options. Opt for a plan with manageable monthly payments and no prepayment penalties.

Total Cost:

Calculate the total cost of the purchase with financing included.

Example:

If you choose a financing plan for the example of the refrigerator with a 8% annual interest rate, the total cost increase might not be substantial ($1,377 vs $1,405) if choosing a term of 6 months to 1 year.

But, and hence the importance of having a budget, the loan’s monthly payment may increase by almost double ($117 vs $229).

.

Ensure you can comfortably afford the monthly payments.

Considering financing options can make a big purchase more feasible but be aware of the additional costs involved.

.

6. Avoid Impulse Purchases

It’s easy to get tempted by spontaneous buying, especially for big-ticket items. Practice patience and avoid making impulsive decisions.

Strategies to Avoid Impulse Purchases:

Wait 24 Hours:

Before making a big purchase, give yourself at least 24 hours to think it over. This cooling-off period helps you assess whether it’s a need or just a fleeting desire.

Research and Compare:

Take time to research the product, compare prices, and read reviews. This ensures you’re making an informed decision and getting the best value for your money.

Stick to Your Budget:

Adhere to your pre-set savings goals and budget. Avoid deviating from your plan, even if you’re tempted by promotions or sales.

Example:

If you’re considering buying a new smartwatch but have not reached your savings goal, wait for 24 hours and revisit your budget before making the purchase.

Avoiding impulse purchases helps you stay focused on your savings goal and prevents unnecessary spending.

.

7. Review Your Progress

Regularly monitoring your savings progress keeps you on track and allows you to make adjustments as needed.

Steps to Review Progress:

Track Savings:

Use a savings tracker template to record your monthly contributions and remaining balance.

Adjust Goals:

If your financial situation changes, adjust your savings goal or time frame accordingly. For example, if you receive a pay raise, consider increasing your monthly savings.

Celebrate Milestones:

Acknowledge and celebrate reaching milestones along the way. This helps maintain motivation and commitment.

Example:

If you’ve saved $1,000 out of a $1,500 goal after 3 months, track this progress and adjust your savings plan if necessary to meet your target by the deadline.

Reviewing your progress regularly ensures you remain motivated and can make necessary adjustments to stay on track.

.

.

In summary…

Start saving today for that big purchase you’ve been dreaming about.

.

Your takeaway…

By following these budgeting tips, you can confidently budget to make your dream a reality while maintaining financial stability.

.

Now your turn. Share in the comments…

What is your dream Big Purchase you will budget for?

I want to visit my Puerto Rico. It’s been too long since my children and I have hugged my dad.

.

.

.

.

+ View comments

+ Leave a comment