Building a Safety Net

.

.

Hey there! I hope you’re doing well.

Today, let’s talk about something incredibly important but often overlooked—building an emergency fund. I know, it’s not the most exciting topic, but trust me, having that financial cushion can be a lifesaver when life throws those unexpected curveballs.

So, let’s dive in and chat about how to set up your emergency fund, step by step. We’ll also touch on how you can make this process easier, even if you’re just starting out.

.

1. Set Up an Emergency Fund: Your Financial Safety Net

Imagine this: your car suddenly breaks down, or an unexpected medical bill arrives. These situations are stressful enough without the added worry of how to pay for them.

This is where an emergency fund comes in. It’s your financial safety net, designed to cover unexpected expenses without derailing your budget.

Goal:

Aim to save 3-6 months’ worth of expenses. This might sound like a lot, but think of it as a gradual process. Start small, and build up over time.

.

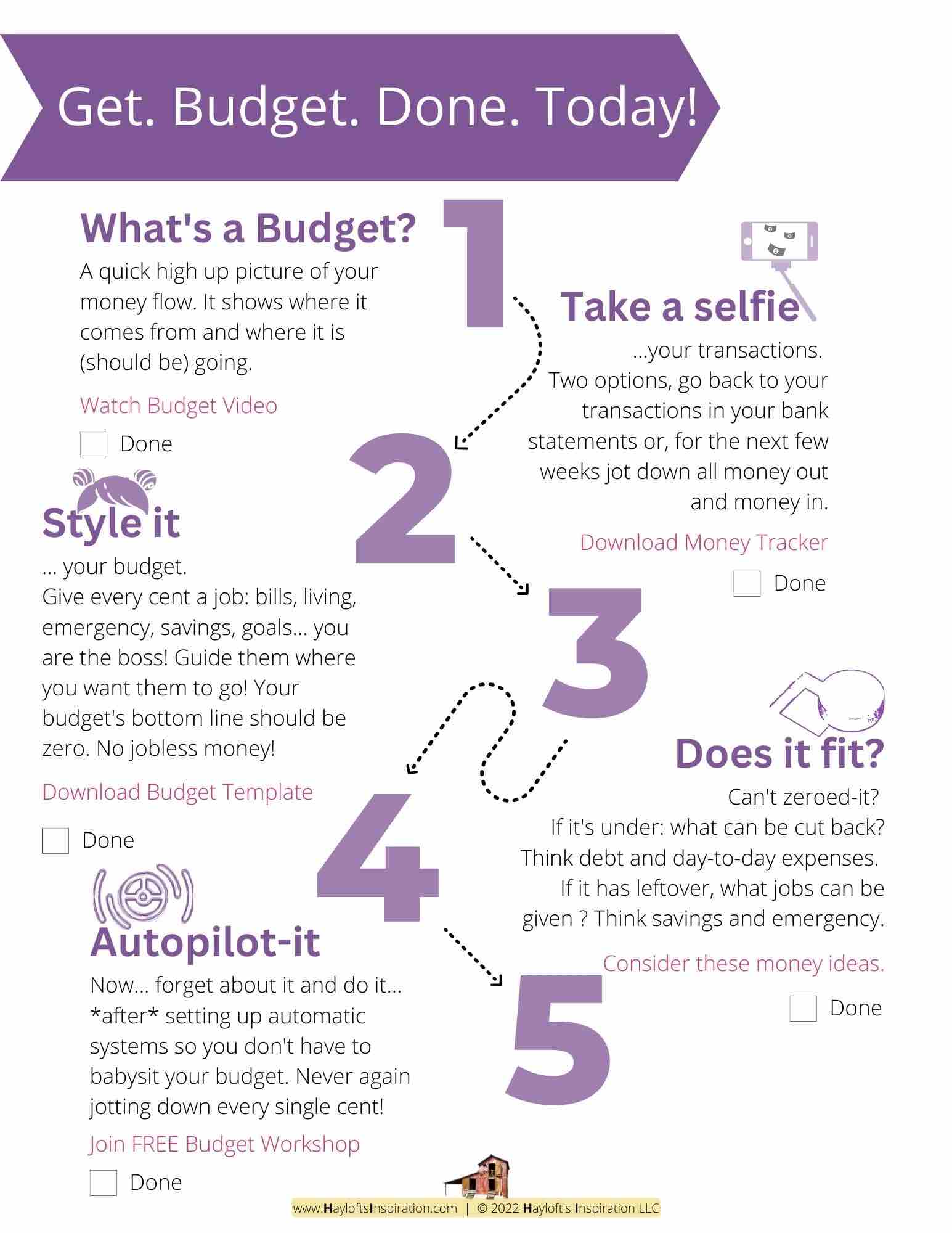

2. Automate Contributions: Set It and Forget It

Once you’ve decided to start an emergency fund, the next step is to automate your contributions. This is one of the easiest ways to ensure that your fund grows without you having to think about it constantly.

How to Do It:

Set up automatic transfers from your checking account to your savings account each time you get paid. Even if it’s just $20 or $50 a paycheck, it adds up over time.

The beauty of automation is that it removes the temptation to skip a contribution, and you’ll be surprised how quickly your savings grow.

.

.

3. Keep Funds Accessible: Easy Access Without Temptation

Your emergency fund needs to be accessible, but not too accessible. You want it somewhere you can reach in an emergency, but not so easy to access that you’re tempted to dip into it for non-emergencies.

Where to Keep It:

A high-yield savings account is often the best option. It’s separate from your regular checking account, so you’re less likely to touch it, but still accessible when you really need it.

.

4. Prioritize High-Interest Debt: Avoid Financial Strain

If you’re carrying high-interest debt, such as credit card debt, it’s important to prioritize paying it down as you build your emergency fund. High-interest debt can snowball quickly, making it harder to recover financially if an emergency does occur.

How to Balance:

.

Start by allocating a portion of your budget to pay down high-interest debt while still contributing to your emergency fund. You don’t have to do one or the other—both can happen simultaneously.

For example, if you have $200 extra each month, you might put $100 toward your emergency fund and $100 toward your debt.

.

.

5. Review Insurance Coverage: Protect What Matters Most

Insurance is a key component of your financial safety net. Without adequate coverage, an emergency can quickly turn into a financial crisis.

What to Check:

Make sure you have adequate health, home, and car insurance. Review your policies to ensure they cover your needs, and consider increasing your coverage if necessary. Sometimes, a small increase in your premium can save you from a huge financial burden down the road.

.

6. Cut Non-Essential Spending: Accelerate Your Savings

To build your emergency fund faster, consider temporarily cutting back on non-essential spending. This doesn’t mean you have to give up everything you enjoy, but small sacrifices can add up quickly.

Where to Cut Back:

Look at your budget and identify areas where you can temporarily reduce spending. This might include dining out, entertainment, or subscriptions you don’t use often. Redirect the money you save into your emergency fund.

.

7. Reevaluate Your Fund Annually: Adjust as Needed

Your financial situation will change over time, so it’s important to review and adjust your emergency fund annually. This might mean increasing your savings if your expenses have gone up, or it might mean you’re in a position to start investing more aggressively once your fund is fully stocked.

How to Review:

Set a date once a year to review your finances, including your emergency fund. Check your current expenses, any changes in your income, and adjust your savings goal if necessary.

.

.

In summary…

Start Building Your Emergency Fund Today

.

Your takeaway…

You don’t have to wait until you have a lot of extra money to start an emergency fund. Even small amounts add up over time, and the peace of mind you’ll gain is priceless.

Emergency funds are an integral part of our ONE Budget method.

To know more register here https://hayloftsinspiration.com/budget-guide .

.

Now your turn. Share in the comments…

Start today, even if it’s just a small contribution, and watch your emergency fund grow.

.

.

.

+ View comments

+ Leave a comment