Preparing Financially for Parenthood

.

.

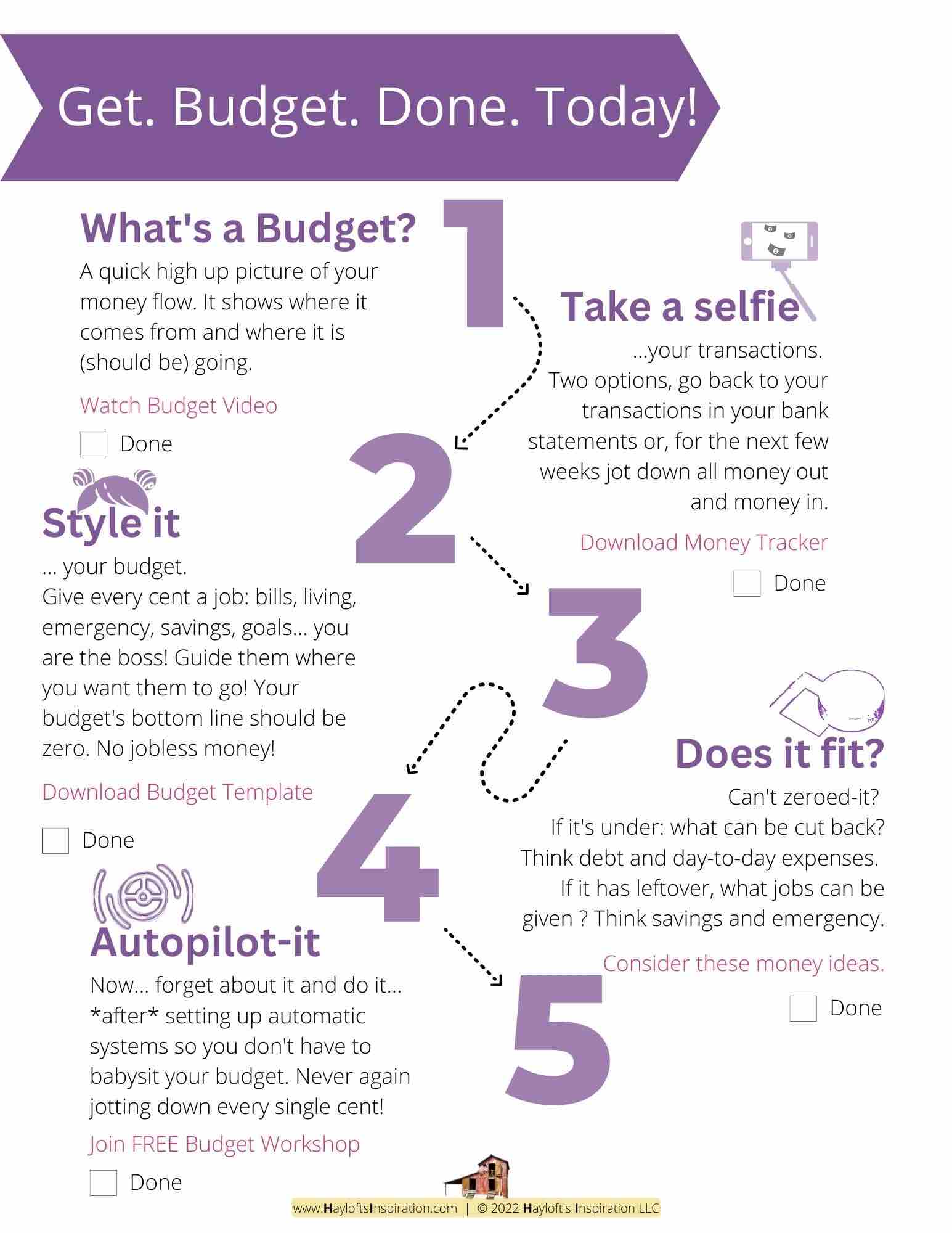

Welcoming a new baby into your life is one of the most exciting and transformative experiences you’ll ever go through. But along with the joy comes a lot of responsibility—and yes, that includes financial planning. If you’re expecting a little one or just thinking ahead, budgeting for a new baby can help ease the financial transition and set you up for success. Let’s walk through some essential tips and practical steps to help you prepare financially for parenthood.

.

1. Estimate Baby-Related Expenses

Before your baby arrives, it’s crucial to get a handle on the expected costs. Babies come with a variety of expenses, and having a clear understanding can help you budget more effectively. Here are some key areas to consider:

- Diapers: On average, you might spend around $70-$80 a month on diapers. That’s approximately $840-$960 annually.

- Formula: If you’re using formula, expect to spend around $100-$150 a month, totaling about $1,200-$1,800 annually.

- Healthcare: Regular check-ups and vaccinations are essential. Budget for co-pays and any unexpected medical expenses. This can range widely but consider setting aside $500-$1,000 for initial healthcare costs.

.

2. Create a Baby Fund

Starting a baby fund is one of the best ways to prepare for the financial demands of parenthood. Ideally, you should begin saving as soon as you find out you’re expecting. Here’s how to set up and grow your baby fund:

- Set a Goal: Determine how much you want to save based on your estimated expenses. Aiming for $2,000-$3,000 is a good starting point.

- Open a Separate Account: Consider opening a dedicated savings account for baby-related expenses. This keeps your savings separate from your regular funds.

- Automate Savings: Set up automatic transfers from your checking account to your baby fund to ensure consistent savings.

.

.

3. Review Health Insurance

Your health insurance will play a significant role in covering maternity and pediatric care costs. It’s essential to understand what’s covered and what you might need to pay out of pocket:

- Maternity Care: Check if your plan covers prenatal visits, labor, and delivery. Some plans may have high deductibles or co-pays.

- Pediatric Care: Ensure that your baby’s well visits, vaccinations, and any potential emergencies are covered.

- Plan for Costs: Review your policy and create a budget for any anticipated co-pays or out-of-pocket expenses.

.

4. Plan for Parental Leave

Understanding and budgeting for parental leave is crucial for a smooth transition into parenthood. Here’s what you need to consider:

- Employer Policy: Review your employer’s parental leave policy to understand how much paid or unpaid leave you’ll receive.

- Income Loss: If your leave is unpaid or partially paid, budget for any income loss. Consider setting aside additional savings to cover this period.

- Adjust Budget: Plan for how your expenses might change while you’re on leave, including any additional costs related to your baby.

.

.

.

5. Buy Second-Hand

Buying second-hand baby items can be a great way to save money. Many baby products are only used for a short time and can be purchased at a fraction of the new cost:

- Common Items: Look for second-hand cribs, changing tables, and baby clothes.

- Quality Check: Ensure that items are in good condition and meet current safety standards.

- Sources: Check local thrift stores, online marketplaces, and community groups for gently used baby gear.

.

6. Budget for Childcare

Even if you’re not planning to use childcare immediately, it’s important to budget for future expenses:

- Research Costs: Look into the average cost of daycare or babysitters in your area. Costs can range from $200 to $1,500 per month, depending on the type of care and location.

- Plan Ahead: Start setting aside money for childcare in your baby fund or as part of your monthly budget.

.

7. Update Your Will and Insurance

Ensuring your family’s future security is an important part of preparing for a new baby:

- Update Your Will: Make sure your will includes provisions for your baby’s care and guardianship.

- Review Life Insurance: Ensure you have adequate life insurance coverage to provide for your family in case of an unforeseen event.

- Beneficiaries: Update beneficiary designations on your accounts and insurance policies.

.

.

.

In summary…

Starting to budget for your new arrival today can help you navigate the financial aspects of parenthood with confidence.

.

Your takeaway…

By preparing ahead of time, you’ll be able to focus on enjoying those precious first moments with your baby, knowing that you’ve planned well for their future. A living budget -as we call it here in Hayloft’s Inspiration- will you in this transition of expanding your family.

.

Now your turn. Share in the comments…

How many kids do you have? Or want?

I have 4 kids here with us. One is waiting to meet us in heaven. And I live praying for my nephews & nieces… there’s unfortunately too many miles & sea between us. I love them all!!

.

.

.

+ View comments

+ Leave a comment