How to Finance and Save on Your Next Vehicle

.

.

Hola!

If you’re in the market for a new car or just thinking about upgrading, you’re probably feeling a mix of excitement and trepidation. After all, buying a car is a significant investment, and you want to make sure you’re making the best choice for your finances. Don’t worry—I’ve got you covered with some practical tips to help you navigate the process, along with a personal story prompt to help you connect your own experiences.

.

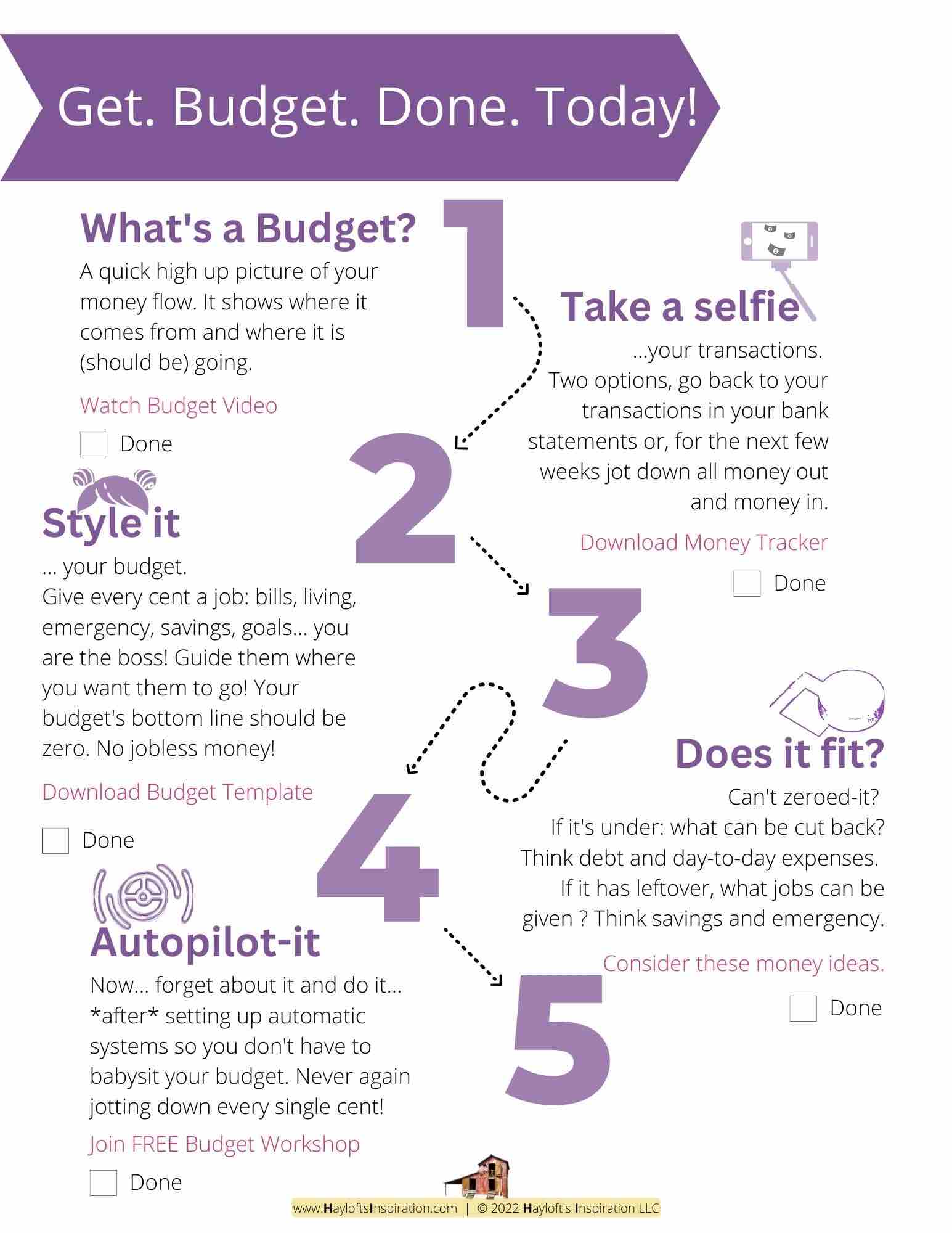

1. Determine What You Can Afford

Before you dive into the car-buying process, it’s crucial to figure out what you can afford. This isn’t just about the price tag on the car but includes all the associated costs, like loan payments, insurance, and maintenance.

Example:

Let’s say you’ve been eyeing a car that costs $20,000. First, calculate the monthly payment for a loan—assuming a 5-year term and a 5% interest rate, your payment might be around $377 per month. Add in insurance, which might cost $100 monthly, and don’t forget maintenance and gas. Make sure these costs fit comfortably within your budget.

Have you ever?

Remember when you had to decide on a big purchase, like a new appliance or a vacation? Reflect on how you assessed what you could afford and how that helped you make a decision.

.

2. Consider Buying Used

New cars lose value quickly, so buying used can be a smart way to save money. A gently used car can be a great deal and still offer many years of reliable service.

Example:

Suppose you’re looking at a new car priced at $25,000. Instead, consider a 2-year-old model that’s still under warranty but priced at $17,000. You could save $8,000 and still get a great vehicle.

Have you ever?

Think of a time when you opted for a more budget-friendly option, like buying gently used clothing or furniture. How did it work out for you, and what did you learn from that experience?

.

.

3. Shop Around for Financing

Don’t settle for the first loan offer you get. Shop around with different lenders—banks, credit unions, and online lenders—to find the best interest rate and loan terms.

Example:

If one lender offers a 5% interest rate and another offers 4%, over a 5-year loan, you could save hundreds of dollars in interest. It’s worth the effort to compare offers.

Have you ever?

Recall a time when you compared different options before making a decision. Maybe it was for a major purchase or a financial decision. How did comparing options help you make a better choice?

.

4. Factor in All Costs

When budgeting for a car, consider all associated costs: insurance, registration, taxes, and maintenance. These costs can add up quickly, so it’s essential to include them in your budget.

Example:

Along with your loan payment, you’ll need to budget for insurance (around $100/month), registration fees (typically $200/year), and taxes (varies by location). Make sure you account for these additional expenses in your monthly budget.

Have you ever?

Reflect on a time when you forgot to include certain costs in your budget. How did it affect your plans, and what did you do to adjust?

.

.

.

5. Save for a Down Payment

A larger down payment can significantly reduce your loan amount, leading to lower monthly payments and less interest paid over the life of the loan.

Example:

If you put down 20% on a $20,000 car, that’s $4,000. This means you’ll only need to finance $16,000, reducing your monthly payments and the total interest you’ll pay.

Have you ever?

Remember when you saved up for something special, like a vacation or a new gadget? How did having a larger amount saved up impact your purchase?

.

6. Avoid Long-Term Loans

While longer loan terms might offer lower monthly payments, they can cost you more in interest over time. Aim for shorter loan terms to save on interest and pay off your car faster.

Example:

A 5-year loan at 5% interest might cost you $377/month, while a 7-year loan at the same rate might be $290/month. However, the longer term will result in paying more in interest over the life of the loan.

Have you ever?

Think of a time when you chose a shorter-term option, like a shorter loan term or a quicker repayment plan. How did this choice benefit you in the long run?

.

7. Plan for Maintenance

Owning a car means dealing with regular maintenance and unexpected repairs. Set aside money each month for these expenses to avoid surprises.

Example:

Budget $50/month for routine maintenance like oil changes and tire rotations. This can help you cover small repairs and avoid financial stress when larger issues arise.

Have you ever?

Recall a time when you prepared for unexpected costs, like a home repair or a medical expense. How did planning ahead help you manage these costs?

.

.

.

In summary…

By following these tips and steps, you’ll be well-equipped to make an informed decision about your next car purchase.

.

Your takeaway…

Begin by setting up an automatic transfer to a dedicated savings account for your down payment. This way, you’ll be prepared and confident when it’s time to make a purchase.

Remember, it’s all about finding the right balance between what you need and what you can afford. Happy car hunting!

.

Now your turn. Share in the comments…

Ready to get started on your car-buying journey?

I have a theory that cars with bright flashy colors tend to not be involved in as many accidents… they are difficult to NOT see. What do you think? Do you have a preferred car color?

.

.

.

+ View comments

+ Leave a comment