Managing the Costs of Continued Learning

.

.

Hola!

If you’re considering investing in your education or personal development, you’re embarking on a journey that can be both exciting and financially demanding. From tuition fees to textbooks, managing these costs can feel overwhelming, but with the right strategies, you can make it more manageable.

Let’s dive into some practical tips to help you budget effectively for your education while also taking a look at a visual idea to make your budgeting journey a bit easier.

.

1. Research Education Costs

Understanding the full cost of your education is the first step in effective budgeting. It’s not just about tuition—there are books, lab fees, and other expenses to consider. Here’s how to get a clear picture:

Steps:

1. List All Expenses: Create a comprehensive list including tuition, books, supplies, and any additional fees.

2. Check College Websites: Visit your chosen institutions’ websites for accurate and updated cost information.

3. Use Cost Calculators: Many schools offer online calculators to estimate total expenses.

.

2. Look for Scholarships and Grants

Scholarships and grants can significantly reduce your out-of-pocket costs, making your education more affordable. Here’s how to find and apply for them:

Steps:

1. Search Online: Use scholarship search engines like Fastweb or Scholarship.com.

2. Check with Institutions: Look for scholarships and grants offered directly by your educational institution.

3. Prepare Your Application: Tailor your essays and applications to highlight your achievements and goals.

.

.

3. Work While Studying

Balancing work and study can be challenging but rewarding. A part-time job or work-study program can help cover living expenses and provide additional income.

Steps:

1. Explore Campus Jobs: Look for work-study positions or part-time jobs offered by your college.

2. Check Local Opportunities: Find part-time jobs in your area that fit with your class schedule.

3. Manage Your Time: Create a schedule to balance work, study, and personal time effectively.

.

4. Consider Community College

Starting at a community college before transferring to a four-year institution can save you a substantial amount of money.

Steps:

1. Research Transfer Agreements: Look for community colleges with transfer agreements with four-year institutions.

2. Compare Costs: Analyze the cost differences between community colleges and four-year schools.

3. Plan Your Course Load: Ensure that the courses you take at the community college will transfer to your desired four-year institution.

.

.

.

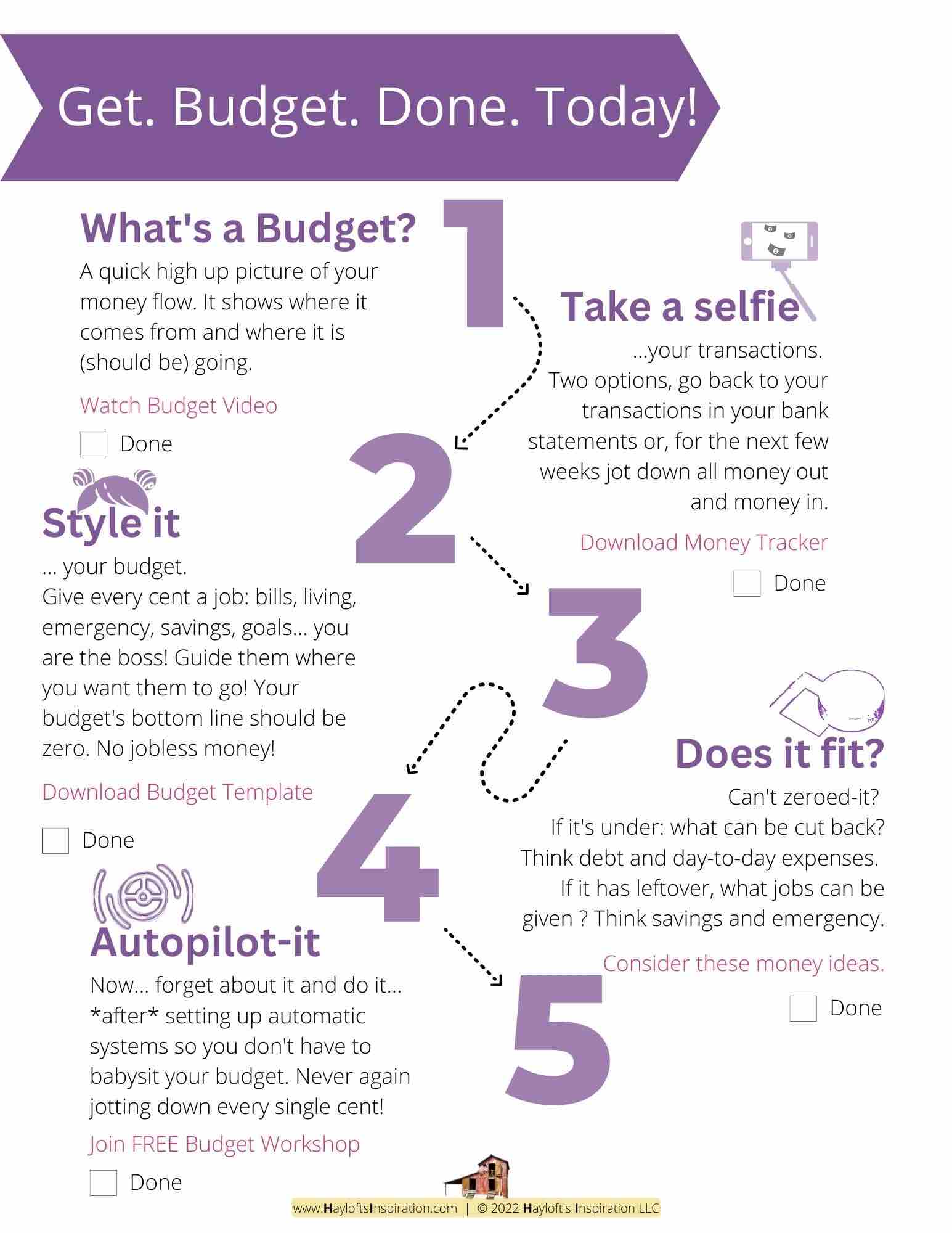

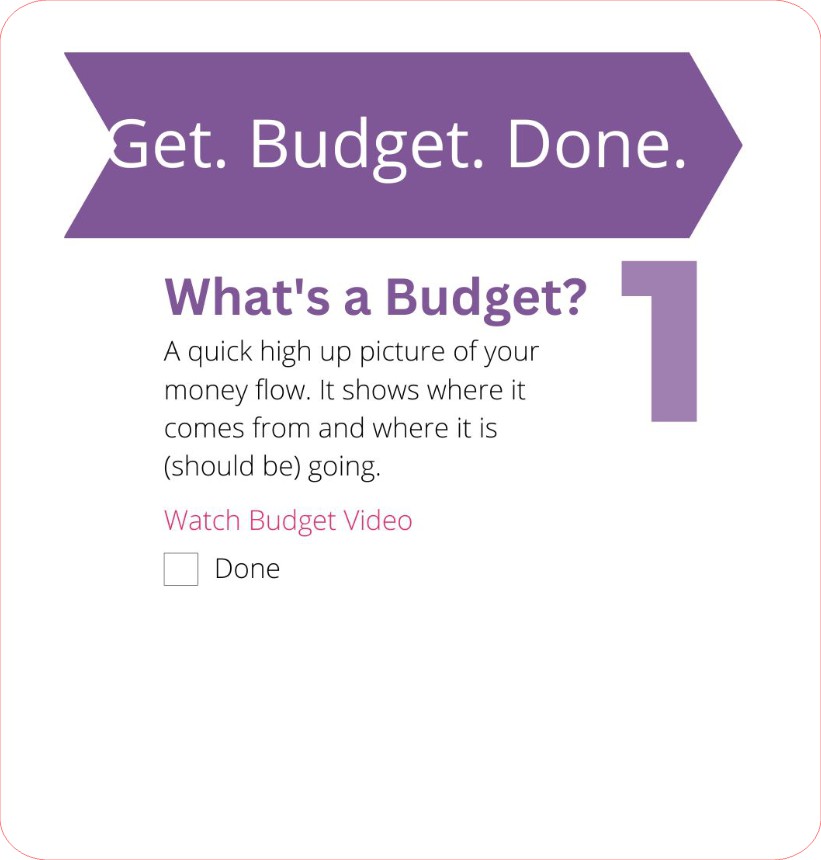

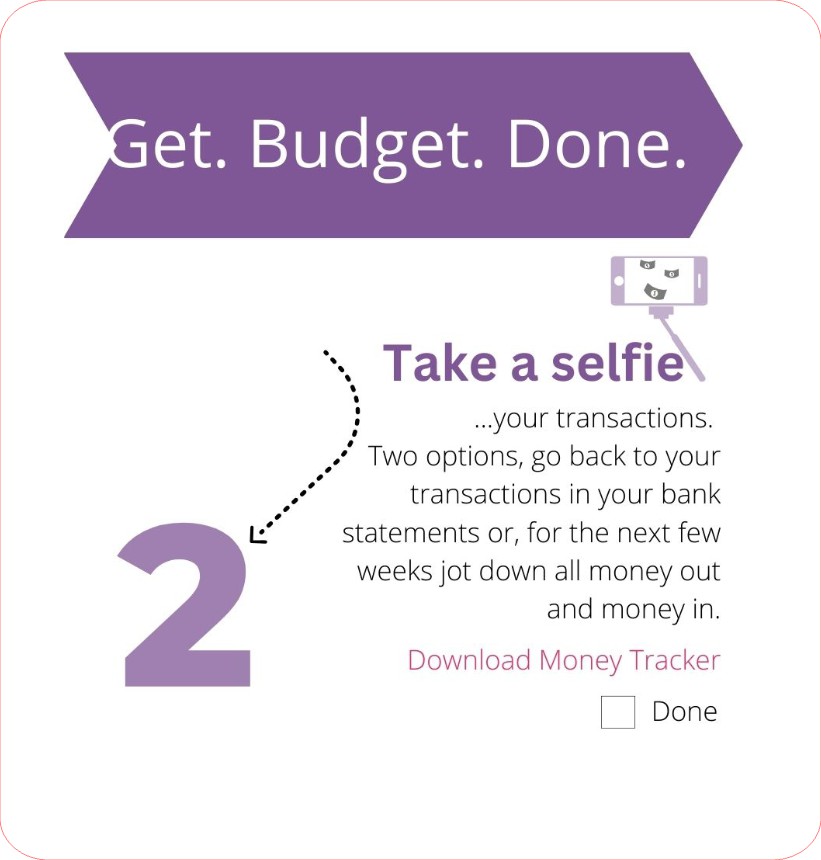

5. Create a Detailed Budget

A detailed budget helps you keep track of all education-related costs, ensuring that you don’t overlook any expenses.

Steps:

1. Categorize Expenses: Divide your budget into categories such as tuition, books, housing, and transportation.

2. Estimate Monthly Costs: Calculate your monthly expenses and compare them with your income.

3. Track Your Spending: Use budgeting apps or spreadsheets to monitor your expenses and adjust as needed.

.

6. Minimize Student Loans

While loans can be a necessary part of funding your education, it’s important to borrow wisely and only what you need.

Steps:

1. Review Loan Options: Compare federal and private loan options.

2. Borrow Wisely: Only take out loans for the amount you need, considering your future earning potential.

3. Understand Terms: Familiarize yourself with interest rates, repayment schedules, and any fees associated with the loans.

.

7. Plan for Repayment

Starting to plan your loan repayment strategy before graduation helps avoid default and reduces stress after you complete your studies.

Steps:

1. Explore Repayment Plans: Look into different repayment options such as income-driven plans or refinancing.

2. Create a Repayment Budget: Allocate funds for loan payments in your monthly budget.

3. Set Up Automatic Payments: Consider setting up automatic payments to ensure you never miss a due date.

.

.

In summary…

Start managing your education costs today by creating a detailed budget and exploring financial aid options. By following these steps, you’ll simplify the process of funding education and managing costs.

.

Your takeaway…

By planning ahead and utilizing available resources, you can make your educational journey more affordable and less stressful.

.

Now your turn. Share in the comments…

Would you like to share what you want to learn or pursue continuing education?

.

.

.

+ View comments

+ Leave a comment