Tips for Financial Harmony

.

.

Hey there!

Navigating finances as a couple can be both exciting and challenging. It’s not just about managing money; it’s about building a life together, where financial harmony plays a big role. I know that discussing money with your partner can sometimes feel tricky or even uncomfortable, but with a little care and openness, it can strengthen your relationship.

Let’s dive into some practical tips for budgeting as a couple, along with a personal story you might relate to, and a fun visual idea to help you make these tips come alive.

.

1. Have Open Conversations About Money

Talking about money is often easier said than done, right? But trust me, having open conversations about your finances is the foundation for budgeting as a couple.

Start by setting aside some time where you both feel relaxed, maybe over a cup of coffee or a cozy dinner at home. Talk about your financial backgrounds, how you each view money, and what your financial goals are. It’s important to understand where each of you is coming from.

Have you ever?

Think about a time when you had to work with a friend or colleague to plan something—maybe a trip or a project at work. You both had different ideas, but you had to compromise and come to an agreement. How did that conversation go? What did you learn about collaboration and compromise? That’s the kind of communication you want to bring into your financial discussions with your partner.

.

2. Set Joint Financial Goals

Once you’re comfortable talking about money, it’s time to set some joint financial goals. These goals could be short-term, like saving for a vacation, or long-term, like buying a house. The key is to make sure you’re both on the same page about what you want to achieve together. Setting these goals can actually be a lot of fun—it’s like planning your future together!

Have you ever?

Think of a time when you and someone else shared a goal, like training for a race together or planning a big event. What motivated you to work together, and how did having a shared goal impact your relationship? This is similar to setting financial goals with your partner—it brings you closer and gives you something to work toward together.

.

.

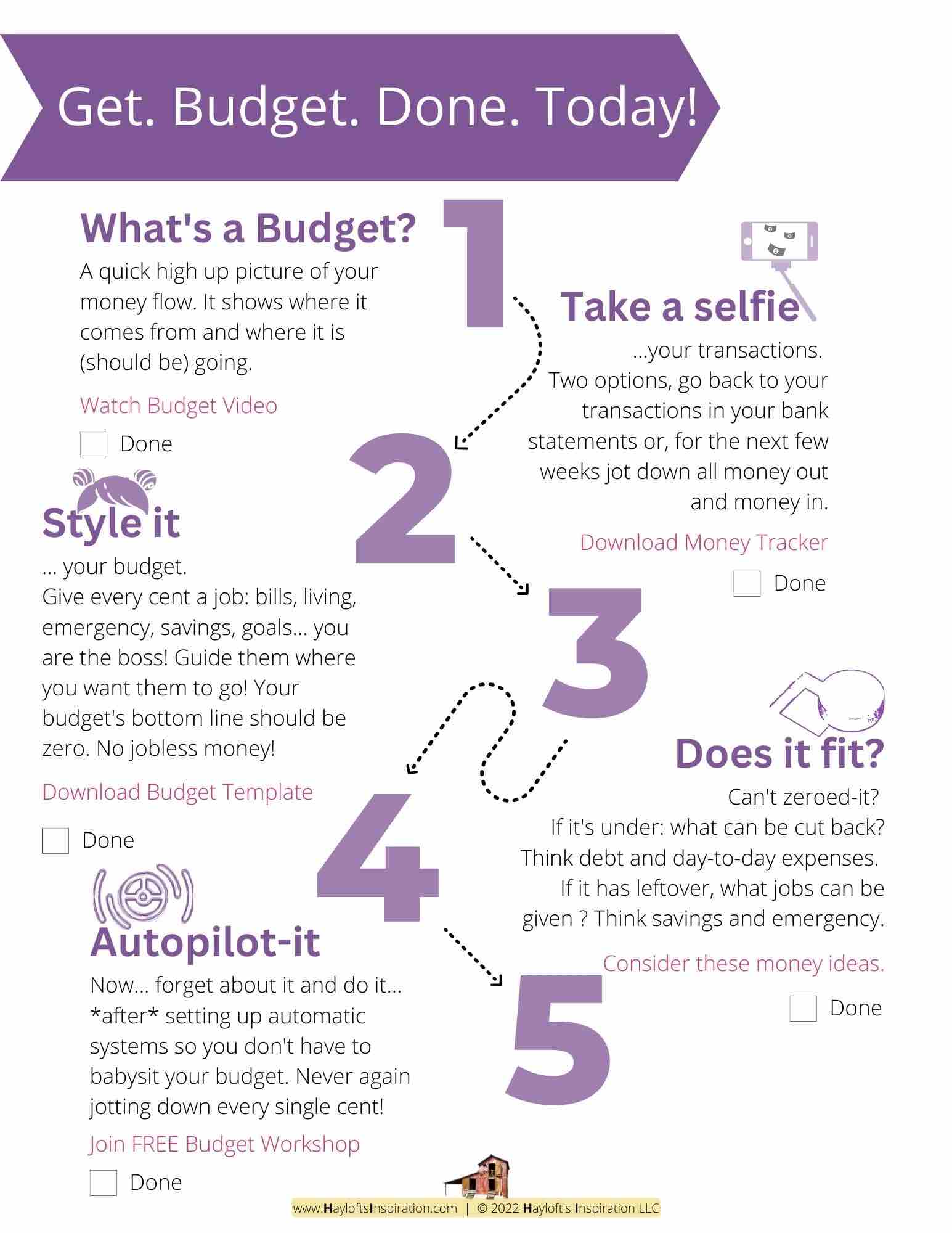

3. Decide on a Budgeting Method

When it comes to managing your finances as a couple, there’s no one-size-fits-all approach. You might decide to combine all your finances, keep everything separate, or find a hybrid method that works for both of you. Some couples like to combine their incomes and pay all the bills together, while others prefer to split everything 50/50 or based on income proportions.

Take some time to discuss which method feels right for you. You might even try one approach and see how it works before committing to it long-term. The most important thing is that both of you feel comfortable and that the method supports your financial goals.

Have you ever?

Reflect on a time when you had to figure out the best way to tackle a project or challenge. Maybe you were part of a team at work or a group project in school, and you had to decide how to divide tasks. How did you decide who would do what? How did you ensure everyone felt good about the plan? That’s similar to deciding on a budgeting method with your partner.

.

4. Create a Joint Budget

Now that you’ve discussed your goals and chosen a budgeting method, it’s time to create a joint budget. This budget should include all of your shared expenses, such as rent or mortgage, groceries, utilities, and any other regular bills. Don’t forget to budget for fun things too, like date nights or weekend getaways!

Start by listing all your income sources and then your expenses. Be sure to leave some wiggle room for unexpected expenses. If one of you is more of a numbers person, they might take the lead on this, but make sure both of you are involved and understand where the money is going.

Have you ever?

Think about a time when you had to plan something that involved multiple people, like organizing a family gathering or a group trip. How did you make sure everyone’s needs were met, and the plan worked for everyone involved? Creating a joint budget is a bit like that—it’s about making sure everyone’s on the same page and happy with the plan.ith strategic planning.

.

.

5. Respect Individual Spending

While it’s important to budget together, it’s also crucial to respect each other’s need for individual spending. Just because you’re managing your finances as a couple doesn’t mean you have to account for every penny your partner spends on personal items. Set aside some money in your budget for personal spending, and agree that you won’t question each other’s choices.

This helps maintain a sense of independence and prevents resentment from building up over money. It’s all about balance—sharing your financial life while still enjoying the freedom to spend on the things that matter to you individually.

Have you ever?

Think about a time when you and a friend wanted to do something different with your free time. Maybe you wanted to go to a concert, and your friend preferred a quiet night in. How did you respect each other’s choices while still maintaining a strong friendship? That’s similar to respecting individual spending in a relationship.

.

6. Review and Adjust Together

Your budget isn’t set in stone. Life changes, and so will your financial situation. That’s why it’s important to regularly review your budget together and make adjustments as needed. Maybe one of you gets a raise, or your expenses change—whatever the case, it’s essential to revisit your budget and make sure it still aligns with your goals.

Schedule a monthly or quarterly “money date” where you sit down and review your finances together. It doesn’t have to be a long meeting—just a quick check-in to see how things are going and if any adjustments are needed.

Have you ever?

Think of a time when a plan didn’t go exactly as expected, and you had to adapt. Maybe it was a road trip that took an unexpected turn, or a work project that required some last-minute changes. How did you handle it? This is similar to reviewing and adjusting your budget—it’s about being flexible and working together to find solutions.

.

7. Use Tools for Transparency

Finally, consider using budgeting tools and apps that both of you can access. This helps keep everything transparent and avoids any misunderstandings about where the money is going. There are plenty of apps out there that allow you to track your spending, set goals, and even automate bill payments.

Find a tool that works for both of you and make it part of your financial routine. This way, both of you can check in on your finances at any time and feel confident that you’re on track with your goals.

Have you ever?

Think about a time when using a tool or system helped you stay organized and on track with a project. Maybe it was a to-do list app or a project management tool at work. How did it help you and those you were working with stay in sync? That’s what a budgeting tool can do for you and your partner.

.

.

In summary…

By setting joint goals, choosing the right budgeting method, and staying transparent with your spending, you’ll be well on your way to financial harmony.

.

Your takeaway…

Here in Hayloft’s Inspiration, our motto for Budgeting & Couples is:

You are ONE budget away from a unified marriage in all areas.

From money, to plans, to future.

.

Now your turn. Share in the comments…

Ready to start budgeting as a team? Start an open dialogue with your partner about your finances. If you so wish, make a friendly commitment in the comments, give yourself a due date to have this conversation with your spouse.

To know more about my story of when my hubby and I had this conversation, read My About here.

If you want to hear & see me “speaking with my hands” the Puertorrican way, register here at https://hayloftsinspiration.com/budget .

.

.

.

+ View comments

+ Leave a comment