Managing Finances as an Entrepreneur

.

.

Hola!

If you’re running your own business, you know how exciting—and sometimes overwhelming—managing finances can be. It’s a lot like juggling; one wrong move and everything can come crashing down.

But don’t worry, I’m here to help you balance those balls with ease. Let’s dive into some practical budgeting tips that will help you keep your business finances in check and set you up for success.

.

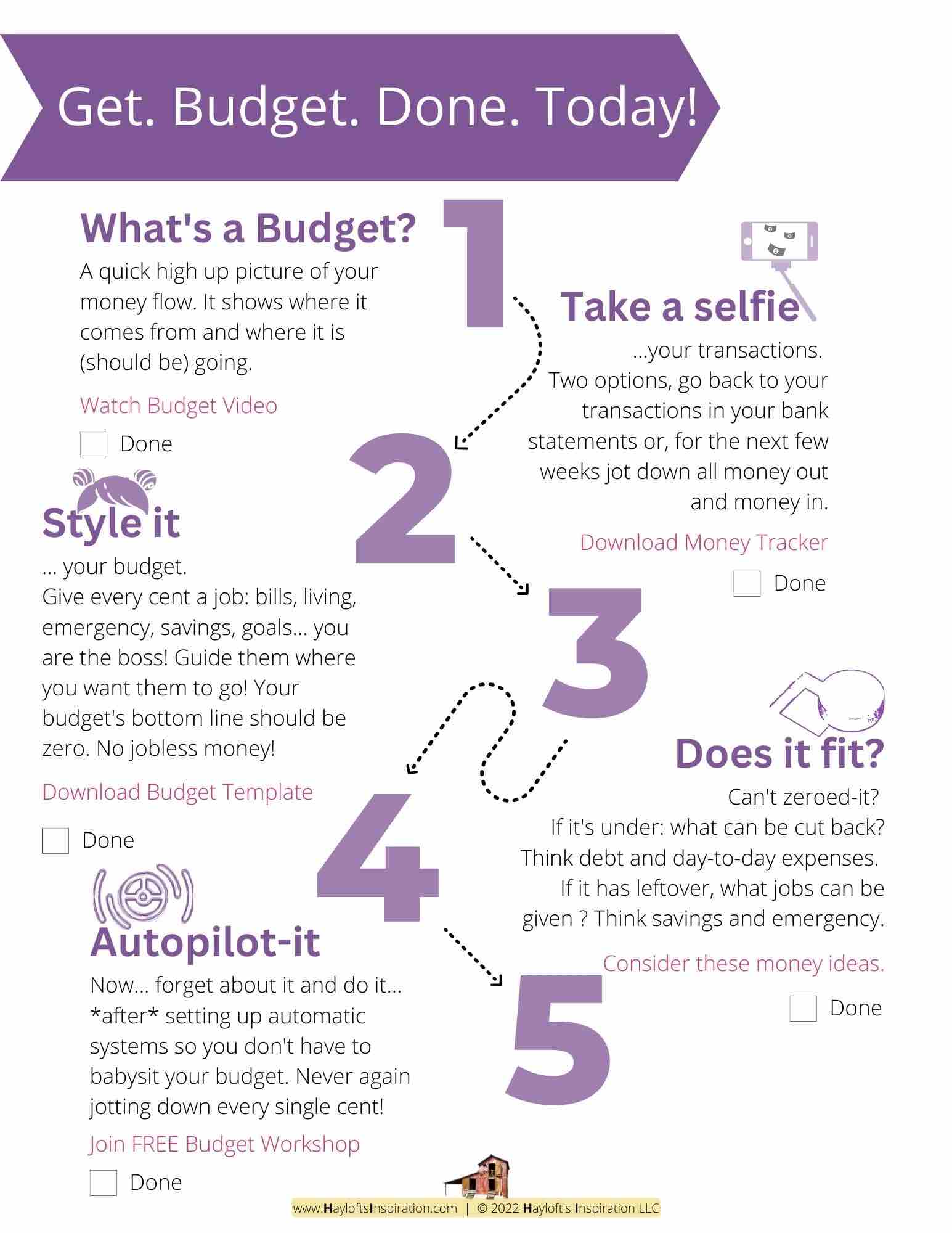

1. Create a Business Budget

Creating a business budget is like laying the foundation of a house. It’s essential to know where every penny is going so you can plan for growth and manage expenses efficiently.

What to Include:

- Rent or Lease: Your office space or storefront.

- Utilities: Electricity, water, internet.

- Salaries and Wages: Pay for yourself and any employees.

- Marketing: Costs for ads, promotions, and social media.

- Supplies and Inventory: Everything you need to run your business.

- Insurance: Protection for your business assets.

.

2. Separate Personal and Business Finances

It’s tempting to use the same bank account for personal and business expenses, but keeping them separate is crucial. It helps with accurate bookkeeping, simplifies tax filing, and gives you a clearer picture of your business’s financial health.

Steps to Take:

- Open a separate business bank account.

- Use this account for all business transactions.

- Apply for a business credit card for business expenses.

.

.

3. Plan for Taxes

Taxes can be a major expense if you’re not prepared. Setting aside money for taxes and making quarterly estimated payments can help you avoid surprises at tax time.

What to Do:

- Estimate Annual Taxes: Calculate how much you’ll owe based on your revenue and expenses.

- Set Aside Funds: Regularly transfer a portion of your income to a separate tax savings account.

- Quarterly Payments: If required, make estimated payments throughout the year.

.

4. Track Cash Flow

Monitoring your cash flow is essential to ensure your business remains solvent. It helps you see how much money is coming in and going out, so you can make informed decisions.

How to Track:

- Use Accounting Software: Tools like QuickBooks or Xero can help.

- Review Regularly: Check your cash flow statement monthly.

- Look for Trends: Identify patterns in your income and expenses.

.

.

.

5. Limit Overhead Costs

Keeping your overhead costs low helps maximize your profits. Look for ways to reduce expenses without compromising on quality.

Cost-Cutting Tips:

- Work from Home: Save on office rent.

- Negotiate Deals: Get better prices from suppliers.

- Reduce Utility Bills: Implement energy-saving measures.

.

6. Reinvest in Your Business

Reinvesting some of your profits back into your business can spur growth and enhance your operations.

Ways to Reinvest:

- Upgrade Equipment: Invest in better tools or technology.

- Expand Marketing: Reach new audiences with targeted ads.

- Employee Training: Improve skills and productivity.

.

7. Build an Emergency Fund

Having a reserve fund can cover unexpected expenses or business downturns. It’s like having a safety net to catch you when things don’t go as planned.

Steps to Build Your Fund:

- Determine the Amount: Aim for 3-6 months’ worth of expenses.

- Set Up a Separate Account: Keep this fund separate from your operating funds.

- Contribute Regularly: Add a portion of your profits to this fund.

.

.

.

In summary…

Now that you have these tips in your toolkit, it’s time to take action! Start by creating a detailed business budget to get a handle on your finances. Separate your personal and business finances, plan for taxes, and track your cash flow. By limiting overhead costs, reinvesting in your business, and building an emergency fund, you’ll set yourself up for long-term success.

.

Your takeaway…

Ready to take control of your business finances? Create your detailed budget today and watch your business thrive!

.

Now your turn. Share in the comments…

I hope these tips and the visual idea help you manage your business finances more effectively. Happy budgeting!

.

.

.

+ View comments

+ Leave a comment