Turning Extra Income into Savings

.

.

Hola!

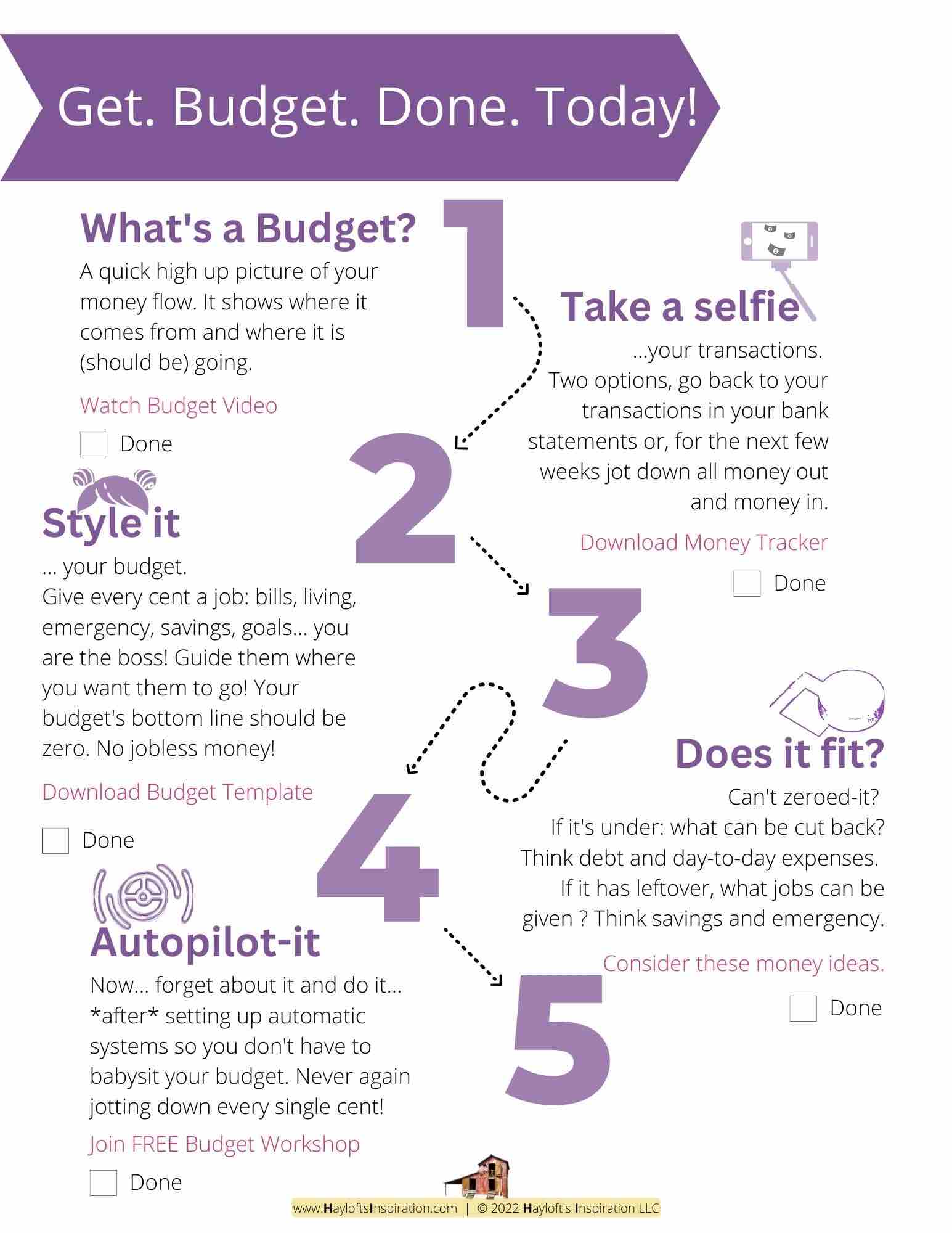

If you’re like many women balancing a side hustle with other responsibilities, you know how rewarding it can be to earn that extra income. But how do you manage all that cash flow, especially when it comes to budgeting?

Today, we’re diving into some practical tips to help you make the most of your side hustle income. Whether you’re freelancing, running a small business, or just picking up a gig on the side, these strategies will help you keep your finances in check and plan for the future.

.

1. Track All Income

First things first: keeping track of your side hustle income is crucial. You might be making money from multiple sources—freelancing gigs, online sales, consulting—and it’s essential to have a clear record of all that cash flow.

Why It Matters:

Accurate tracking helps with budgeting, financial planning, and tax reporting. Imagine you’re juggling several freelance projects. Without a solid record, it’s easy to lose track of how much you’re making and where it’s coming from.

Steps to Create Your Tracking System:

1. Choose a Tool: Use a spreadsheet (Google Sheets or Excel) or a financial app like QuickBooks or Wave.

2. Create Categories: Set up columns for date, source of income, amount, and notes.

3. Record Transactions: Update regularly to keep track of every payment.

.

2. Deduct Business Expenses

Next, don’t forget to track and deduct your legitimate business expenses. These are costs that are necessary for running your side hustle and can reduce your taxable income.

Why It Matters:

Deducting expenses means you’ll pay less in taxes and have a clearer picture of your actual profits.

Steps to Track Expenses:

1. Save Receipts: Keep digital or physical copies of all receipts related to your side hustle.

2. Categorize Expenses: Group expenses into categories like software, office supplies, or marketing.

3. Record in Your System: Update your tracking tool with expense details.

.

.

3. Separate Finances

To make managing your side hustle finances easier, consider opening a separate bank account just for your side hustle.

Why It Matters:

A separate account simplifies bookkeeping and keeps your side hustle income and expenses distinct from your personal finances.

Steps to Set Up a Separate Account:

1. Choose a Bank: Look for a bank that offers business accounts with low fees.

2. Open an Account: Provide necessary documentation and set up the account.

3. Use Exclusively for Side Hustle: Deposit all side hustle earnings into this account and pay expenses from it.

.

4. Save for Taxes

Set aside a portion of your side hustle income for taxes. Since side hustle income doesn’t typically have withholding, you’re responsible for paying estimated taxes.

Why It Matters:

Saving for taxes prevents surprises and ensures you have the funds ready when tax payments are due.

Steps to Save for Taxes:

1. Estimate Tax Liability: Use a tax calculator to estimate how much you owe.

2. Create a Tax Savings Account: Open a savings account dedicated to taxes.

3. Automate Transfers: Set up automatic transfers from your side hustle account to your tax savings account.

.

.

.

5. Reinvest in Growth

Consider reinvesting a portion of your side hustle earnings into tools, education, or marketing that can help grow your business.

Why It Matters:

Investing in growth can increase your earning potential and improve your side hustle’s success.

Steps to Reinvest in Your Side Hustle:

1. Identify Growth Areas: Decide where investment can make the most impact (e.g., new software, marketing).

2. Set Aside Funds: Allocate a percentage of your earnings for growth.

3. Make Investments: Purchase tools or enroll in courses that will benefit your side hustle.

.

6. Automate Savings

Automate transfers from your side hustle income to a savings or investment account.

Why It Matters:

Automating savings ensures that you consistently save without having to think about it, helping you build a financial cushion or fund future goals.

Steps to Automate Savings:

1. Determine Savings Goal: Decide what you’re saving for (e.g., emergency fund, retirement).

2. Set Up Automatic Transfers: Use your bank’s online tools to schedule regular transfers.

3. Monitor and Adjust: Periodically review your savings progress and adjust as needed.

.

7. Consider the Long-Term

Think about how your side hustle fits into your overall financial goals. Whether it’s paying off debt, saving for a big purchase, or investing, having a long-term plan helps you stay focused and motivated.

Why It Matters:

Aligning your side hustle with your long-term financial goals ensures that you’re not just earning money, but using it in a way that supports your overall financial health.

Steps to Plan for the Long-Term:

1. Define Financial Goals: Set clear, achievable goals for your side hustle income.

2. Create a Plan: Outline how you will use your side hustle income to meet these goals.

3. Review Regularly: Check your progress and adjust your plan as needed.

.

.

In summary…

By following these tips and steps, you’ll be able to manage your side hustle income effectively, turning it into a valuable asset for your financial future.

.

Your takeaway…

Ready to take control of your side hustle income? Start by setting clear financial goals and tracking your earnings today. With these tips, you’ll be well on your way to turning your side hustle into a powerful tool for achieving your financial dreams.

.

Now your turn. Share in the comments…

What ideas are you looking to start as a Side Hustle?

.

.

.

+ View comments

+ Leave a comment