How to Get Out of Debt Faster

.

.

Hola!

I know how overwhelming debt can feel, and if you’re like many of us, you might be looking for ways to tackle it more effectively. Getting out of debt isn’t just about numbers and spreadsheets—it’s about creating a path to a more secure and stress-free future. So let’s dive into some practical tips to help you pay off your debt faster and make your financial goals a reality.

.

1. List All Your Debts

Start by listing every single debt you owe. It might feel a bit daunting at first, but getting everything down on paper can be incredibly empowering. Here’s what to include:

- Debt Name: Credit card, student loan, personal loan, etc.

- Balance: How much you owe.

- Interest Rate: The annual percentage rate (APR) for each debt.

- Minimum Payment: The smallest amount you need to pay each month.

.

2. Choose a Repayment Strategy

Now that you have your debts listed, it’s time to choose a repayment strategy. There are two popular methods:

- Debt Snowball: Focus on paying off your smallest debt first while making minimum payments on the others. Once the smallest debt is gone, move to the next smallest. The idea is to build momentum and stay motivated.

- Debt Avalanche: Concentrate on paying off the debt with the highest interest rate first. This approach saves more money in interest over time but might be slower to show results.

.

.

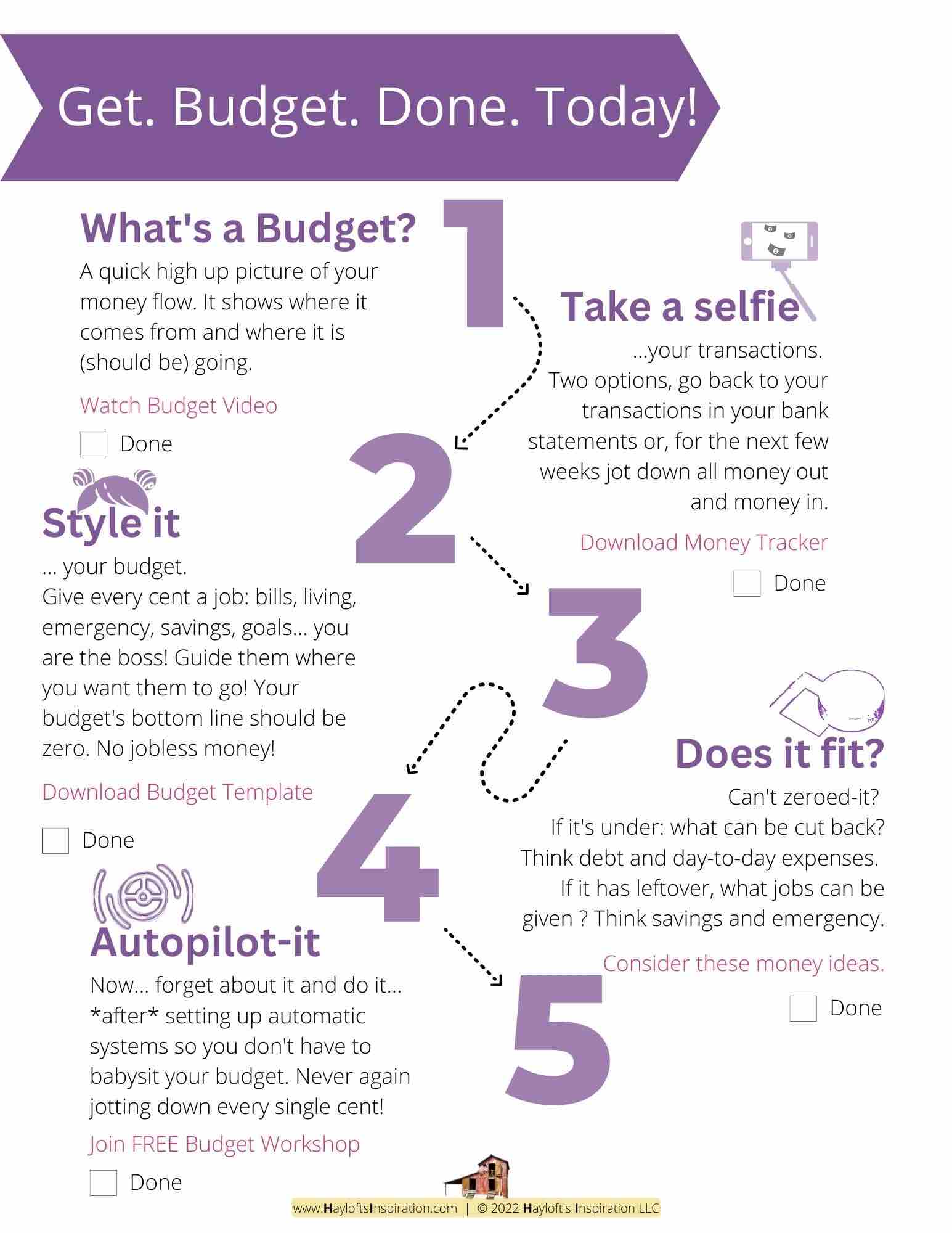

3. Create a Debt Repayment Budget

Revise your budget to allocate extra funds towards your debt repayment. Identify areas where you can cut back and redirect those funds to your debt.

- Track Your Expenses: Identify where your money is going each month.

- Adjust Allocations: Move some of your discretionary spending (like dining out or entertainment) to your debt repayment category.

- Set Up Goals: Determine how much extra you can put toward debt each month and stick to it.

.

4. Cut Non-Essential Spending

Review your spending habits and find areas where you can cut back. It might not be fun, but every bit helps.

- Identify Non-Essentials: Look for subscriptions, memberships, or habits that aren’t crucial.

- Redirect Funds: Use the money saved from cutting these expenses to pay down your debt.

.

.

.

5. Consider Debt Consolidation

If you have high-interest debt, consolidating it into a lower-interest loan or credit card can be a smart move. It can simplify your payments and reduce the amount of interest you’ll pay over time.

- Research Options: Look into balance transfer credit cards or personal loans with lower interest rates.

- Evaluate Fees: Make sure the benefits outweigh any fees associated with consolidation.

.

6. Automate Payments

Set up automatic payments for your debts to avoid missed payments and late fees. This ensures that your payments are made on time, every time.

- Set Up Auto-Pay: Use your bank or creditor’s website to set up automatic payments.

- Choose Payment Dates: Align payment dates with your pay schedule to avoid overdraft fees.

.

7. Celebrate Small Wins

Debt repayment is a marathon, not a sprint. Celebrate your progress to stay motivated.

- Track Milestones: Celebrate each debt you pay off, no matter how small.

- Reward Yourself: Treat yourself to something small (and budget-friendly) for achieving milestones.

.

.

.

In summary…

Creating a debt repayment tracker can help you stay organized and motivated as you work towards becoming debt-free.

.

Your takeaway…

By following these tips and utilizing the tracker, you’ll be well on your way to a more financially secure future.

.

Now your turn. Share in the comments…

Happy budgeting, and remember, every step forward is progress!

And talking about progress, what is your “no-debt” goal date?

.

.

.

+ View comments

+ Leave a comment