How to Save for College

.

.

Hi there!

Saving for college can feel like a daunting task, but with a bit of planning and some smart strategies, it can become a manageable and even rewarding process. Let’s dive into some practical tips to help you start saving for your child’s higher education, and I’ll also share a personal story to illustrate how finding creative solutions can make a big difference.

1. Start a College Savings Account

The first step in saving for college is to open a dedicated savings account. A 529 plan is a popular choice because it offers tax benefits and can be used for various educational expenses. Think of it as a savings jar specifically designed to grow over time and help with college costs.

.

2. Set a Savings Goal

Determine how much you need to save based on current college costs. Research the average tuition and fees for the type of college your child might attend, and set a savings target. Keep in mind that college costs can increase over time, so it’s essential to adjust your goals accordingly.

.

.

3. Look for Scholarships and Grants

Research scholarships and grants available for students. These can significantly reduce the amount of money you need to save. Encourage your child to apply for as many as possible, as every little bit helps.

.

4. Encourage Your Child to Save

Teaching your child about the importance of saving for their education can be empowering. Encourage them to set aside part of their allowance or earnings from a part-time job. This not only helps with the savings but also instills valuable financial habits.

.

.

.

5. Consider Community College

Starting at a community college can significantly reduce the overall cost of obtaining a degree. Many community colleges offer high-quality education at a fraction of the cost of a four-year institution.

.

6. Plan for Living Expenses

Don’t forget to budget for room, board, and other living expenses. These costs can add up quickly, so it’s crucial to factor them into your savings plan. Include estimates for things like textbooks, supplies, and personal expenses.

.

7. Avoid Student Loans If Possible

Minimize or avoid taking on student loans to reduce future debt. Explore all options for grants, scholarships, and savings before considering loans. If loans are necessary, make sure to understand the terms and plan for repayment.

.

.

.

In summary…

Ready to start saving for your child’s education? Open a 529 plan or similar savings account today and set your savings goal in motion!

.

Your takeaway…

Remember, every step you take now can make a big difference in the future!

.

Now your turn. Share in the comments…

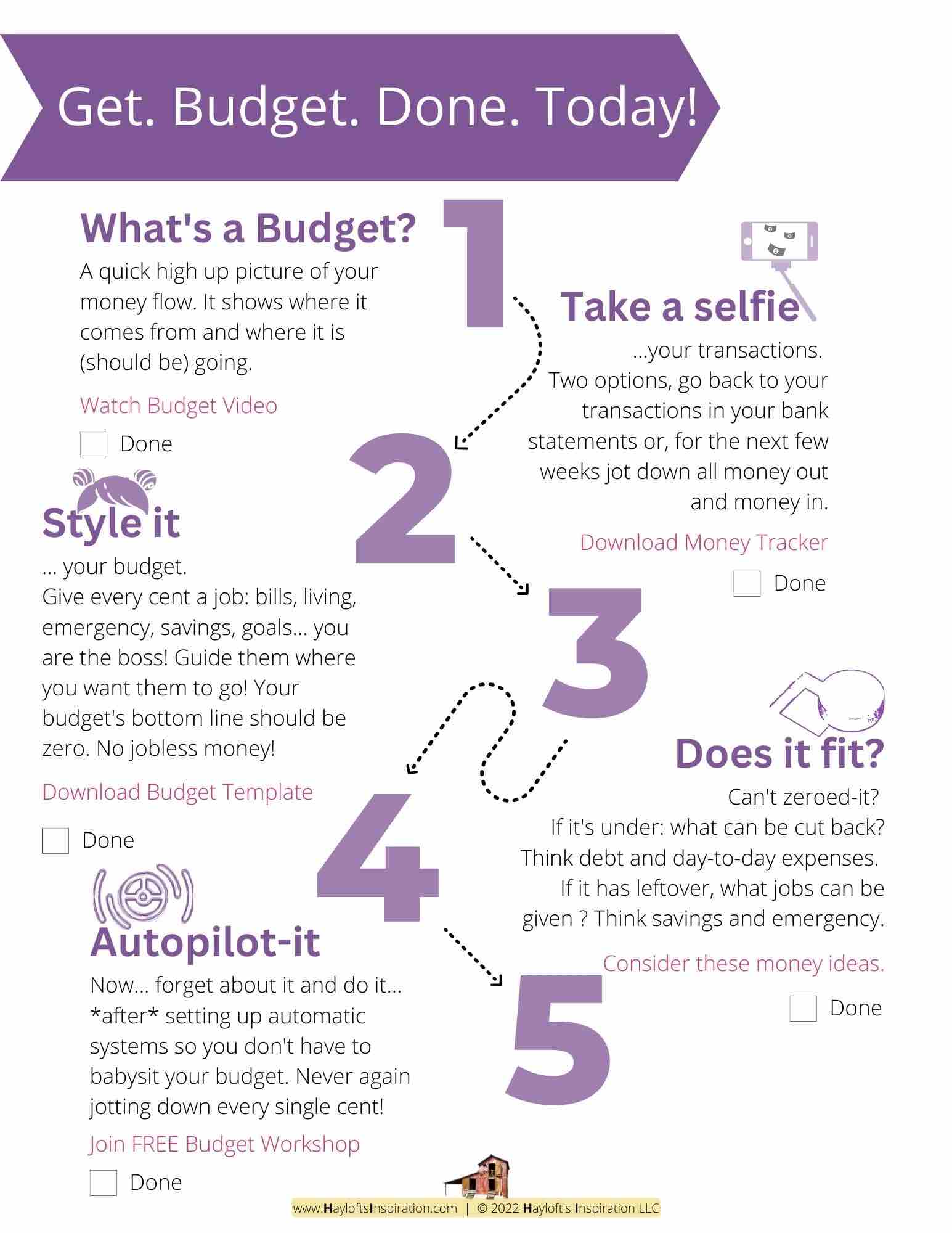

I hope these tips and the infographic guide help you make the process of saving for college a little easier.

.

.

.

+ View comments

+ Leave a comment