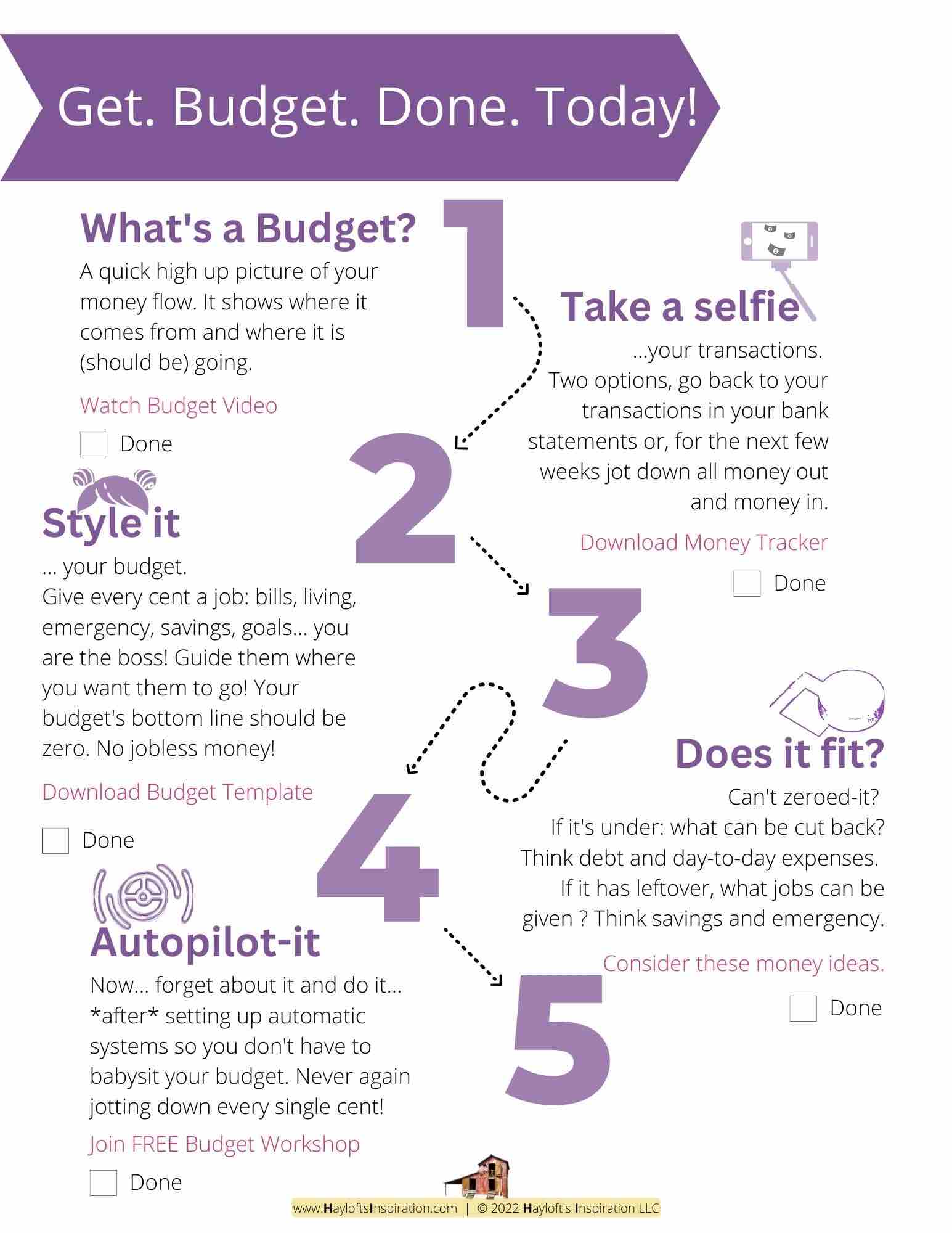

Saving for a Down Payment and Beyond

.

.

Hola!

Are you dreaming of owning your own home? It’s such an exciting milestone, but it requires some thoughtful planning and budgeting. Whether you’re eyeing a cozy cottage or a spacious family home, getting prepared for homeownership involves more than just choosing the right property. It’s about setting clear goals, creating a solid savings plan, and understanding the full picture of homeownership costs.

Let’s dive into some key tips to help you budget for homeownership, along with some real-life examples and a fun visual idea to guide you through the process.

.

1. Set a Homeownership Goal

First things first: define your homeownership goal. This means figuring out how much you need for a down payment, as well as other initial costs. Typically, a down payment is 20% of the home’s purchase price. For a $300,000 home, that’s $60,000. But don’t forget other costs like closing fees, which can add up to another 5% of the purchase price.

Have you ever?

Think about a time when you set a significant goal for yourself, like saving for a special vacation or planning a big event. How did setting a clear goal help you stay motivated? Maybe it was saving for your dream vacation—remember the excitement of hitting your savings target?

.

2. Create a Home Savings Plan

Once you have a goal in mind, it’s time to create a plan to reach it. Decide how much you can realistically save each month towards your down payment. Consider automating your savings by setting up a dedicated account where a portion of your income goes directly into savings each month. The more consistent you are, the faster you’ll reach your goal.

Have you ever?

Reflect on a time when you set up a routine or system to achieve something important. For example, if you started a new exercise routine and stuck to it, how did that structured plan help you achieve your fitness goals?

.

.

3. Research Mortgage Options

Understanding your mortgage options is crucial. There are several types, including fixed-rate, adjustable-rate, and government-backed loans like FHA or VA loans. Each has its own pros and cons, so research thoroughly to find the one that best fits your financial situation and homeownership goals.

Have you ever?

Consider a situation where you had to research and compare different options before making a decision. Maybe it was choosing between different job offers or picking the best car insurance policy. How did the research process help you make a well-informed choice?

.

4. Factor in Closing Costs

Closing costs can be a surprise for many first-time homebuyers. These can include fees for appraisal, title insurance, and loan origination, and typically range from 2% to 5% of the home’s purchase price. Make sure to budget for these additional expenses to avoid any surprises at the closing table.

Have you ever?

Think about a time when unexpected costs came up during a big purchase or project. How did you handle it, and what did you learn from the experience? Maybe it was during a major renovation or a large purchase for your home.

.

.

.

5. Consider Additional Expenses

Homeownership isn’t just about the down payment and closing costs. There are ongoing expenses like property taxes, homeowner’s insurance, and maintenance. It’s essential to include these in your budget to ensure you can comfortably afford your new home.

Have you ever?

Recall a time when you had to plan for ongoing expenses or maintenance for something important. Perhaps it was maintaining a car or managing regular monthly expenses for a family event. How did planning ahead help you manage these costs?

.

6. Save for an Emergency Fund

Having an emergency fund is crucial for unexpected home repairs or issues. Ideally, this fund should cover at least 3-6 months of expenses, including potential repairs or urgent replacements. This way, you’re not caught off guard when unexpected costs arise.

Have you ever?

Share a personal experience where having an emergency fund or savings helped you deal with an unexpected situation. Maybe it was a sudden car repair or a surprise medical expense that you were prepared for.

.

7. Avoid Overextending

While it’s tempting to stretch your budget for a larger home, it’s essential to stay within your means. Don’t buy more house than you can comfortably afford, even if you qualify for a higher mortgage. A manageable mortgage ensures you’re not financially strained and can enjoy your new home without stress.

Have you ever?

Reflect on a time when you made a decision that involved setting boundaries for yourself. It could be choosing a more modest option to stay within budget, like a smaller car or a less extravagant vacation, and how that decision ultimately benefited you.

.

.

.

In summary…

Set up a dedicated savings account today for your down payment, and start working towards your goal.

.

Your takeaway…

Ready to start your journey to homeownership? Every small step you take brings you closer to unlocking the door to your new home!

.

Now your turn. Share in the comments…

I hope these tips help you on your journey to homeownership! If you have any more questions or need further assistance, just let me know. Happy home planning! 🏡✨

.

.

.

+ View comments

+ Leave a comment