How to Manage Family Finances

.

.

Hola,

Managing family finances can feel like juggling a dozen balls in the air. As a parent, you’re not just budgeting for yourself—you’re budgeting for your whole family, and that comes with its own set of challenges. But don’t worry, I’ve got your back!

Today, I want to help you create a family budget that keeps everyone’s needs in check while ensuring there’s room for a little fun. Let’s dive into some practical tips to help you manage your family’s finances with confidence.

.

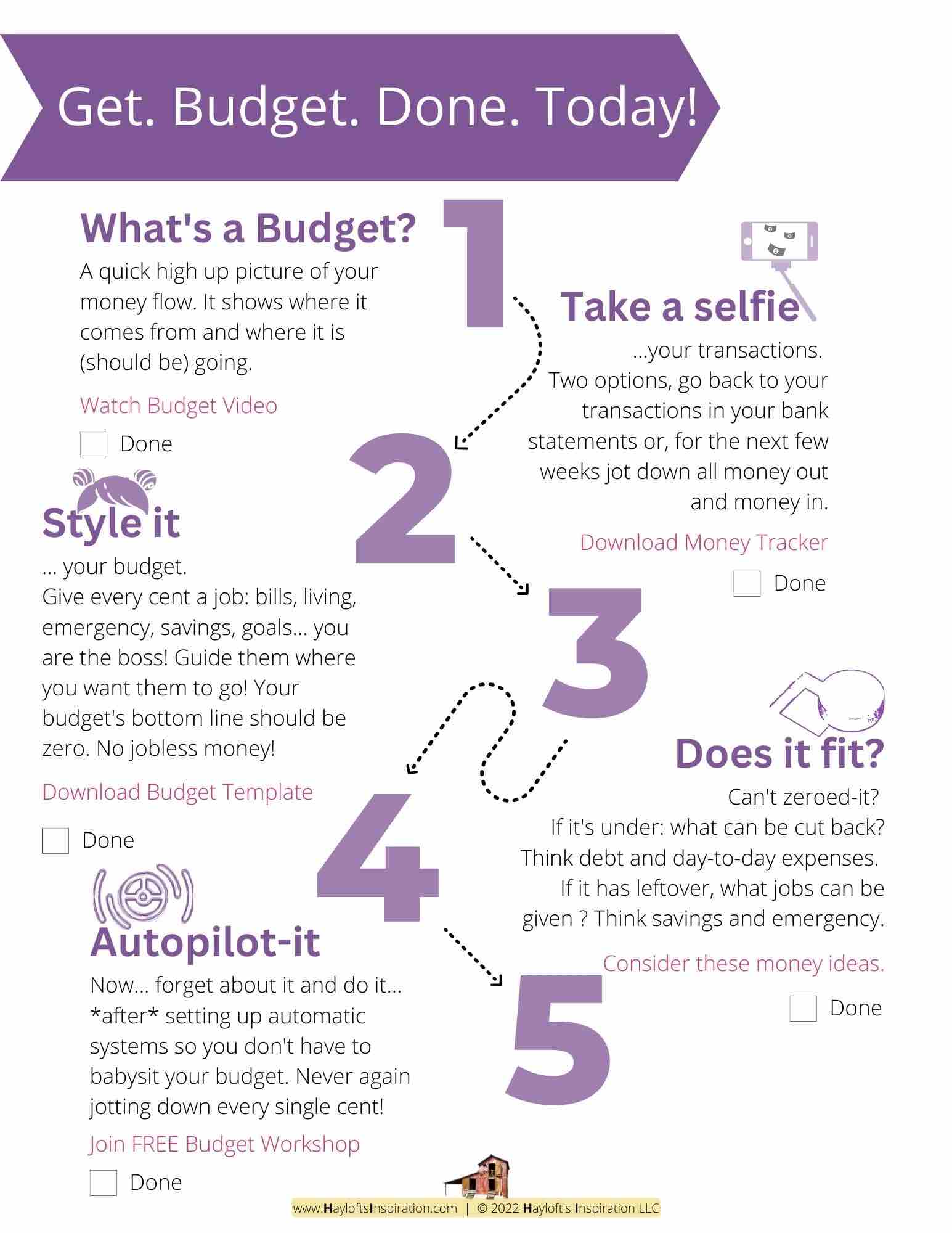

1. Create a Family Budget

Creating a family budget is like setting the foundation for your financial house. It’s essential to know exactly where your money is going each month. Start by listing all your family-related expenses, such as groceries, rent/mortgage, utilities, school fees, and other essentials. Don’t forget about those small, recurring expenses that often slip through the cracks, like subscriptions or snack runs.

Once you have everything listed, compare it with your monthly income. This will give you a clear picture of where you might need to cut back or where you have room to save. Consider using budgeting apps that allow you to track expenses easily.

Trust me, -or continue to reading, you’ll see- it’s a game changer when you can see your spending habits laid out in front of you!

.

2. Plan for Childcare Costs

Childcare is one of those expenses that can take a big bite out of your budget. Whether you’re paying for daycare, a nanny, or after-school programs, it’s important to plan for these costs ahead of time. Start by researching the average cost of childcare in your area and factor that into your monthly budget.

If you have family members who can help with childcare, that’s fantastic! But even if you don’t, there are ways to manage these costs without breaking the bank. Look into government programs or subsidies that might be available to you. Some employers also offer childcare assistance as part of their benefits package, so be sure to check what’s available to you.

.

.

.

3. Save for Education

Education is one of the best gifts you can give your children, but it can also be one of the most expensive. The earlier you start saving for your children’s education, the better off you’ll be. Consider opening a dedicated savings account or a 529 college savings plan that offers tax benefits.

Even if your kids are still young, it’s never too early to start thinking about their future. Set aside a small amount each month, and as your income increases, try to boost your contributions.

The key is consistency—small, regular contributions can add up over time.

.

4. Include Fun Money

All work and no play makes for a very dull family life! It’s important to budget for fun activities, whether it’s a weekend getaway, a trip to the zoo, or a simple family movie night. Allocating “fun money” ensures that your family can enjoy quality time together without feeling guilty about the expense.

The trick is to plan these activities in advance and set a budget for them. This way, you can avoid overspending and still create wonderful memories with your loved ones. Remember, it’s not about how much you spend but the time you spend together that matters most.

.

.

.

5. Review Insurance

As a parent, protecting your family’s future is a top priority. That’s why it’s crucial to review your insurance policies regularly. Make sure you have adequate health insurance, life insurance, and disability insurance. These policies provide a safety net in case something unexpected happens.

When reviewing your insurance, consider your family’s specific needs. For example, if you’re the primary breadwinner, life insurance can ensure your family is taken care of financially if something were to happen to you. Disability insurance is also essential because it can help replace lost income if you’re unable to work due to illness or injury.

.

6. Teach Kids About Money

One of the best ways to ensure your children grow up financially responsible is to involve them in budgeting from an early age. Teach them the basics of money management, such as saving, spending wisely, and understanding the value of money.

You can start with simple lessons, like giving them an allowance and showing them how to save for something they want. As they get older, involve them in more complex financial decisions, like budgeting for a family vacation. Teaching kids about money not only prepares them for the future but also helps them appreciate the effort that goes into managing a family’s finances.

.

7. Plan for Future Expenses

As your children grow, so do their needs—and the costs associated with them. It’s important to plan for future expenses like summer camps, extracurricular activities, and, eventually, college.

The earlier you start planning for these costs, the easier it will be to manage them when the time comes.

One way to do this is to create a separate savings account for future expenses. Each month, contribute a small amount to this account, and let it grow over time. This approach not only helps you prepare for upcoming expenses but also reduces the stress of last-minute financial surprises.

.

.

In summary…

Start Building a Family Budget Today.

Don’t know where to start? Click and begin here.

.

Your takeaway…

Now that you’ve got some solid tips for managing your family’s finances, it’s time to take action. Start by creating a family budget that covers all your essential expenses while leaving room for savings and fun activities.

.

Now your turn. Share in the comments…

Remember, the key to successful budgeting is consistency and planning ahead. By taking control of your finances today.

Would you commit in the comments to get your Budget going? Or at least, to find out how to set up one? Even better, where are you in your Budget path: discovering, learning, trying to start, got one & in maintenance mode?

.

.

.

.

+ View comments

+ Leave a comment