Managing Irregular Income

.

.

Hola!

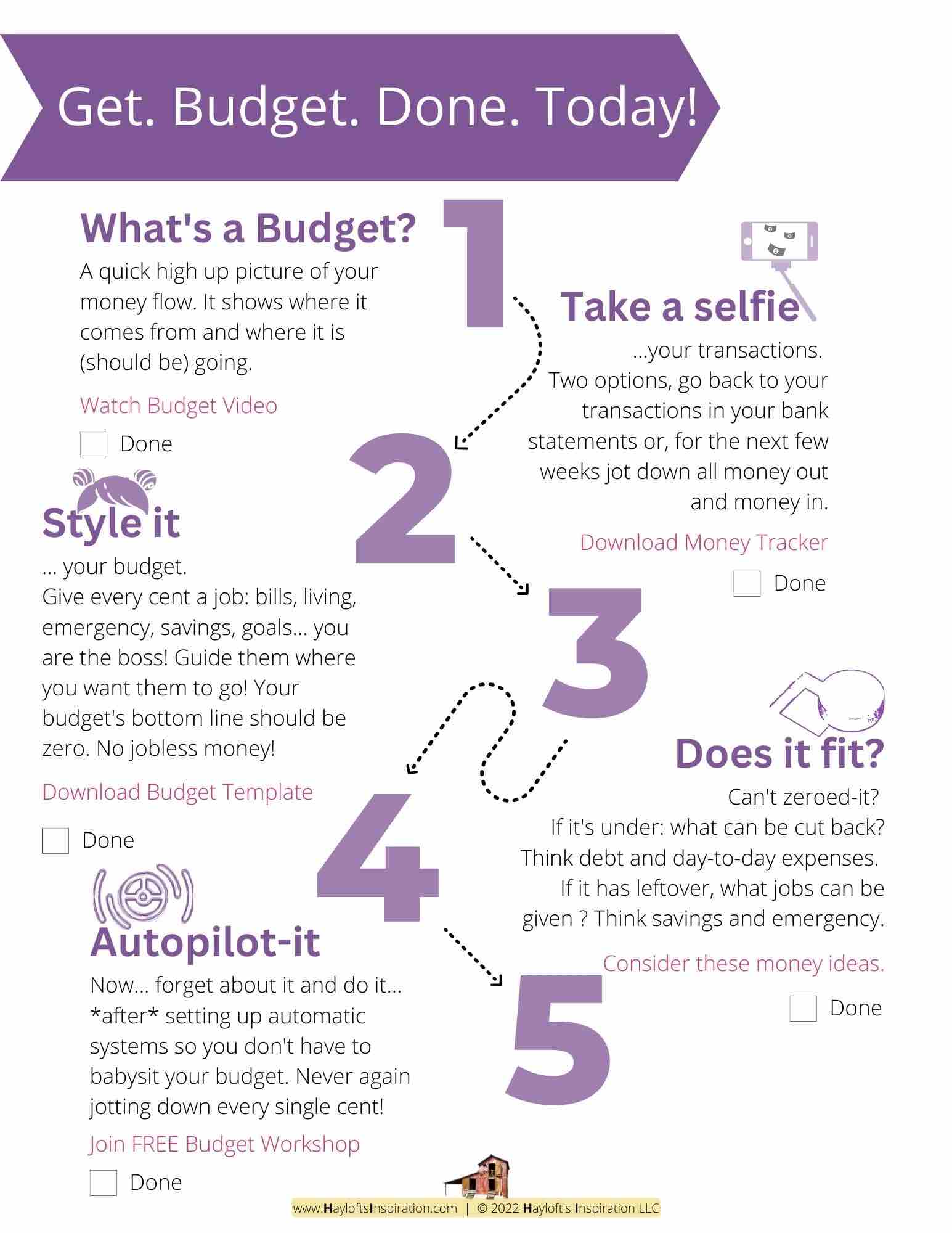

If you’re self-employed, you know that managing your finances can sometimes feel like juggling on a tightrope. One month you might have a windfall, and the next month, you’re scraping by. It can be tricky to balance these ups and downs, but with a few smart strategies, you can keep your financial life in check and make the most of your entrepreneurial journey. Let’s dive into some tips and tricks to help you budget effectively when your income isn’t always steady.

.

1. Calculate Your Average Income

First things first—get a handle on what your typical income looks like. This isn’t about predicting the future with 100% accuracy but about understanding your financial average based on past earnings.

Example:

Look at your income over the past year. Let’s say you earned $4,000 in January, $3,500 in February, and $5,000 in March. Calculate your average monthly income by adding these figures together and dividing by the number of months you’ve reviewed. In this case, you would average out to about $4,167 per month.

Why This Helps:

Knowing your average helps you plan your budget around a more realistic figure, smoothing out the highs and lows of irregular income.

.

2. Separate Business and Personal Finances

Keeping your business and personal expenses separate isn’t just about neatness—it’s crucial for clear financial tracking and tax purposes.

Example:

Open a dedicated business bank account and use it solely for business transactions. This way, when you look at your statements, you’ll see exactly how much money you’re making and spending on your business. You can use personal accounts for your daily living expenses.

Why This Helps:

Clear separation of funds makes tracking expenses easier and ensures you’re not accidentally mixing personal and business finances, which simplifies your bookkeeping and tax filing.

.

.

3. Save for Taxes

One of the biggest surprises for self-employed individuals can be the tax bill. Without an employer withholding taxes from your paycheck, it’s up to you to set aside money for taxes.

Example:

If you estimate that 25% of your income goes to taxes, set aside this amount each month. If you earn $4,000 in a given month, save $1,000 for taxes. You can use a separate savings account specifically for tax funds.

Why This Helps:

By saving a portion of your income for taxes throughout the year, you avoid the stress of a large tax bill when it’s time to file. It also helps you manage your cash flow more effectively.

.

4. Create a Variable Budget

When your income fluctuates, a static budget might not cut it. Adjusting your budget monthly based on your actual income can help you stay on track.

Example:

If you have a high-income month, say $5,000, you might allocate more towards savings or debt repayment. In a lower-income month, like $2,500, adjust your spending on non-essentials like dining out or entertainment.

Why This Helps:

A variable budget allows you to remain flexible and responsive to changes in your income, making it easier to adapt without feeling overwhelmed.

.

.

.

5. Build a Buffer

A financial buffer is your safety net during lean months. By saving extra during high-income months, you can create a cushion to help you through periods of lower income.

Example:

If you earn $1,500 more than your average in one month, save that extra $1,500 in a separate savings account. Use it to cover expenses in months where your income dips below your average.

Why This Helps:

A buffer helps smooth out the financial rollercoaster and provides peace of mind, knowing you have funds set aside to handle unexpected drops in income.

.

6. Track Business Expenses

Keep a close eye on your business expenses. Many of these are tax-deductible and can reduce your taxable income.

Example:

Track all your expenses such as office supplies, software subscriptions, and travel costs. Use accounting software or a simple spreadsheet to record and categorize these expenses.

Why This Helps:

Accurate tracking of expenses ensures you’re not missing out on potential deductions, which can save you money on your taxes and improve your overall financial health.

.

7. Plan for Retirement

Even though you don’t have an employer-sponsored retirement plan, you can still save for your future. Contributing to a retirement account is crucial for long-term financial security.

Example:

Consider setting up a Solo 401(k) or a SEP IRA. You can contribute a percentage of your income or a fixed amount each month. Even small contributions can add up over time.

Why This Helps:

Planning for retirement ensures that you’re preparing for the future, even when your current income is variable. It provides financial stability and peace of mind for your later years.

.

.

In summary…

With these tips and tools, you can effectively manage your finances as a self-employed individual and navigate the ups and downs of irregular income with confidence.

.

Your takeaway…

Remember, it’s all about staying organized and being prepared for both high and low months. If you start managing your finances with these strategies, you’ll find yourself in a better position to handle whatever comes your way. Happy budgeting!

.

Now your turn. Share in the comments…

Just like with hubbies, we may spend so much time on the thing we are doing, that we forget the foundation to keep it going.

A one & good budget for your self-employed project will help you to do the thing, and it will show you clearly how you are doing the thing, how to scale it, and when possible pivot.

Do you have a budget for your self-employed life?

.

.

.

+ View comments

+ Leave a comment