Planning for Major Life Changes

.

.

Hola!

I know life is full of unexpected turns, but with a bit of planning, you can make those major life changes feel a lot smoother. Today, let’s chat about how to budget for future events that could impact your finances, like getting married, buying a home, or starting a family.

I’ll share some tips to help you navigate these milestones with confidence, and I’ll also give you a personal story prompt to make this advice hit closer to home.

.

1. Identify Major Life Events

First things first: let’s think about the major life events that might be on your horizon. It could be anything from a wedding to buying a new home, or even welcoming a new member into your family. Take a moment to jot down the events that you’re anticipating. You might have:

Marriage: Planning a wedding is exciting but comes with its own set of costs.

Buying a Home: This involves a down payment, closing costs, and moving expenses.

Starting a Family: This could include medical costs, baby gear, and future education.

For instance, when I was preparing for my first home purchase, I had to account for the down payment, closing costs, and even unexpected moving expenses. Identifying these events early helped me set clear goals and avoid surprises.

.

2. Estimate Costs

Once you’ve identified these major events, the next step is to estimate the costs associated with them. This can be tricky, but doing some research will give you a realistic idea of what to expect. Here are some examples:

Marriage: According to recent statistics, the average cost of a wedding is around $30,000. This includes everything from the venue and catering to the dress and decorations.

Buying a Home: Depending on your location, the down payment might range from 5% to 20% of the home’s purchase price. For a $300,000 home, that’s between $15,000 and $60,000.

Starting a Family: The cost of raising a child can exceed $12,000 per year, considering healthcare, baby supplies, and other expenses.

When I planned for my wedding, I was amazed at how much each little detail added up. By researching costs beforehand, I was able to set more accurate savings goals and avoid financial stress.

.

.

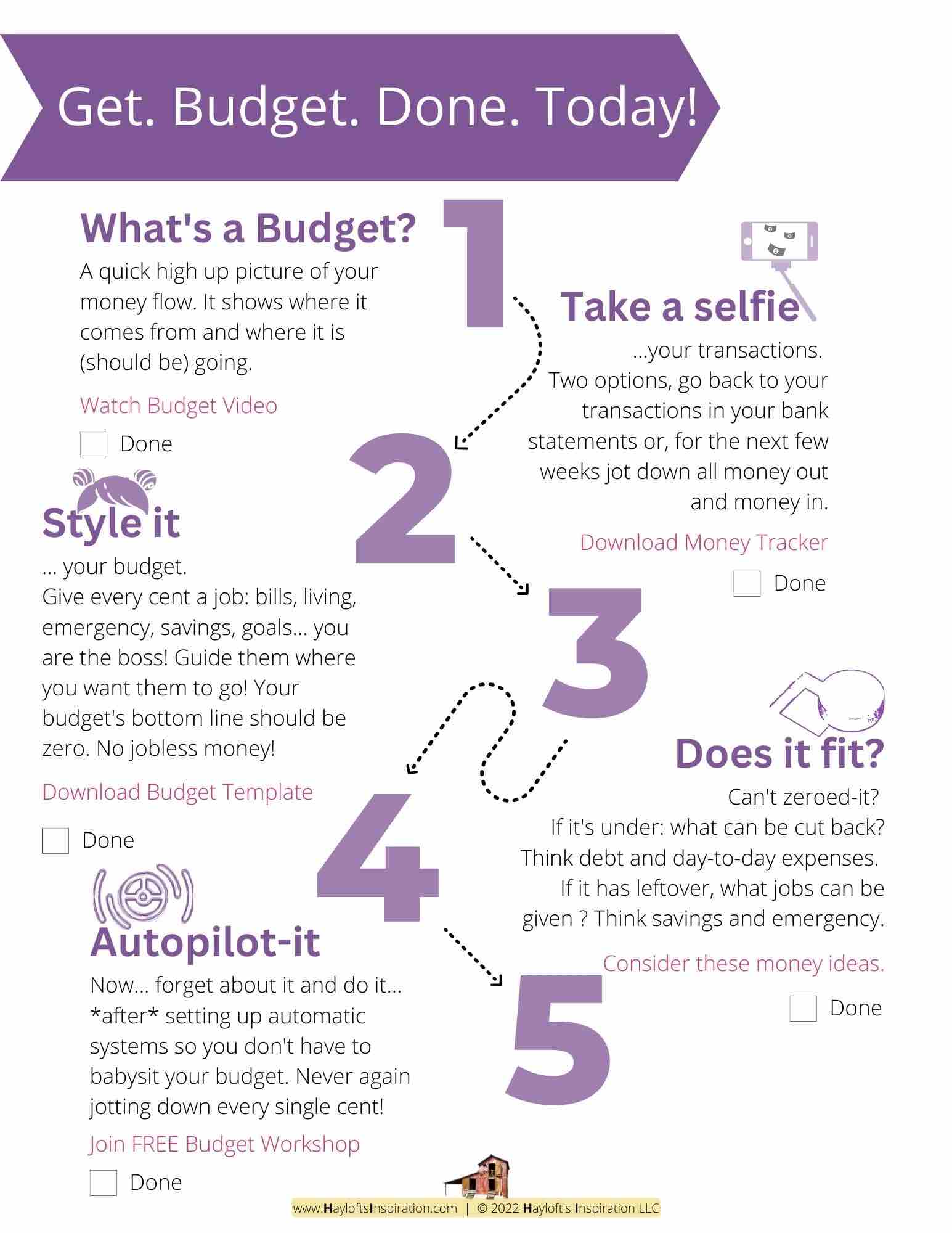

3. Create a Savings Plan

Now that you know the estimated costs, it’s time to create a savings plan. Set aside a specific amount of money each month to cover these future expenses. Here’s how you can do it:

Open a Dedicated Savings Account: Having a separate account for each major event can help you track your progress.

Automate Savings: Set up automatic transfers to your savings account to ensure you consistently save each month.

For example, when I was saving for my home, I set up a dedicated savings account and automated monthly transfers. This made saving feel like a seamless part of my routine.

.

4. Prioritize Goals

Sometimes, you might have multiple goals and limited resources. Prioritize which events are most important and focus your savings efforts on those first. Here’s how:

Evaluate Urgency: If you’re planning a wedding in the next year, that might take priority over a long-term goal like starting a family.

Allocate Funds: Decide how much of your savings should go towards each goal based on its importance and timeline.

When I was juggling saving for my husband’s birthday and Christmas time, I prioritized his birthday because it was happening sooner, and it was a big milestone birthday. I adjusted my savings accordingly to meet the more immediate goal first.

.

.

.

5. Adjust Your Budget

Your budget might need adjustments as you work towards these savings goals. Here’s how to make it fit:

Review Monthly Expenses: Look for areas where you can cut back to increase your savings.

Track Your Progress: Regularly review your budget to ensure you’re on track with your savings goals.

For instance, when I started saving for a big vacation, I found that cutting back on dining out freed up extra money for my travel fund.

.

6. Consider Insurance

It’s crucial to have insurance coverage to protect against unforeseen events. Consider the following:

Health Insurance: Ensure you have adequate coverage for medical expenses, especially if you’re starting a family.

Home Insurance: Protect your investment in case of unexpected damage or loss.

.

7. Review Regularly

Finally, regularly review and adjust your plan as life changes. Here’s how:

Annual Reviews: Check your progress towards your goals at least once a year.

Adjust for Changes: If you experience significant life changes (e.g., a new job or unexpected expenses), update your savings plan accordingly.

I regularly review my financial plans and adjust them based on new goals or changes in my life, like a job promotion or unexpected expenses.

.

.

In summary…

Start planning for your future today!

.

Your takeaway…

Set realistic financial goals for upcoming life events and create a savings plan that works for you. With a little foresight and preparation, you can confidently navigate major life changes without financial stress.

.

Now your turn. Share in the comments…

What major life events are you looking forward to?

.

.

.

+ View comments

+ Leave a comment