Stress-Free Spending

.

.

Hey there,

I know the holidays can be a beautiful, magical time, but let’s be real—they can also bring a lot of stress, especially when it comes to money. It’s easy to get caught up in the excitement and end up spending more than you planned.

But what if I told you that you could have a joyful holiday season without the financial headache?

Let’s dive into some simple, practical tips that will help you enjoy the holidays without breaking the bank.

.

1. Set a Holiday Spending Limit

First things first: decide how much you can afford to spend this holiday season.

This isn’t just about gifts; think about the entire holiday experience—decorations, food, parties, travel, and all those little extras that tend to add up. Setting a spending limit helps you prioritize what’s really important to you and avoid the regret of overspending later.

Example:

Imagine you’re planning a road trip for the holidays. You budget $1,000 for everything—gas, accommodations, food, and activities. Knowing this upfront lets you plan the trip without constantly worrying if you’re going overboard.

Have you ever?

Remember that time when you decided to take a small road trip instead of flying somewhere expensive? The memories you made, like singing along to your favorite songs on the open road, were far more precious than any lavish vacation could’ve provided.

This is a perfect example of how setting limits allows you to focus on what truly matters.

.

2. Make a Gift List

Creating a gift list is a lifesaver. Write down everyone you plan to buy gifts for, from family members to coworkers. Then, assign a budget to each person. This helps you stay organized and ensures you don’t go overboard buying last-minute gifts. Plus, it feels good to check off each person as you go.

Example:

Let’s say you have ten people on your list, and you decide to spend $30 on each. That’s $300 total. Now, you have a clear target, and you can start shopping with confidence, knowing you’re sticking to your budget.

Have you ever?

Think about a time when you made a thoughtful gift for someone, maybe a handmade photo album or a batch of homemade cookies. That personal touch made the gift so special, and it probably cost a fraction of what you would’ve spent on something store-bought.

.

.

.

3. Start Saving Early

We all know the holidays happen at the same time every year, yet they still seem to sneak up on us! One of the best ways to avoid financial stress is to start saving early. Even if you set aside just $20 a month starting in January, by December, you’ll have a nice cushion to cover your holiday expenses.

Example:

Let’s do the math: $20 a month for 12 months gives you $240 by the end of the year. That’s enough to cover a few gifts, some decorations, or even part of your holiday travel expenses. It’s a small step that makes a big difference when the holiday season rolls around.

Have you ever?

Remember that time you planned ahead for a big event, like a wedding or a special trip? The peace of mind you had knowing everything was covered financially allowed you to fully enjoy the experience. The same principle applies to holiday budgeting—starting early means less stress later.

.

4. DIY Gifts

There’s something incredibly meaningful about receiving a handmade gift.

Not only does it show that you put time and thought into it, but it’s also a great way to save money. Whether it’s homemade cookies, a knitted scarf, or a personalized photo album, DIY gifts can be both budget-friendly and cherished.

Example:

Let’s say you decide to bake cookies for your friends and family. You spend $30 on ingredients, and you make enough for ten people. That’s only $3 per person, but the impact is far greater than the cost.

Have you ever?

Have you ever received a gift that was handmade or deeply personalized? Maybe it was a scrapbook filled with memories or a knitted blanket. The love and effort put into that gift made it unforgettable, proving that the best gifts aren’t always the most expensive ones.

.

.

.

5. Shop Sales

Sales are your best friend during the holiday season. Whether it’s Black Friday, Cyber Monday, or pre-holiday sales, there are plenty of opportunities to snag great deals. Plan ahead, make a list of what you need, and stick to it when those sales hit.

Example:

Let’s say you’re eyeing a $100 gadget for a loved one. By waiting for a holiday sale, you score it for $70, saving $30 that can be used elsewhere in your budget.

Have you ever?

Think about a time when you scored an amazing deal on something you’d been wanting for a while. That feeling of satisfaction knowing you got something valuable without paying full price? That’s the kind of win you can carry into your holiday shopping.

.

6. Avoid Last-Minute Shopping

We’ve all been there—rushing around the day before a holiday, grabbing whatever we can find because we ran out of time. Last-minute shopping not only adds to your stress but also increases the likelihood of overspending. Plan ahead and start your shopping early to avoid this pitfall.

Example:

Imagine you start your shopping in November instead of December. You find better deals, have time to compare prices, and avoid the holiday rush. This not only saves you money but also gives you more time to enjoy the season.

Have you ever?

Remember the year you planned everything in advance, from packing for a trip to organizing a big event? How much smoother did things go compared to the times you were scrambling at the last minute? The same principle applies to holiday shopping—early preparation leads to a more relaxed experience.

.

7. Plan for Other Expenses

Gifts aren’t the only costs to consider during the holidays. There are decorations, holiday parties, special meals, and possibly travel expenses. These can add up quickly if you’re not careful. By including these in your budget from the start, you can avoid any surprises.

Example:

Let’s say you budget $200 for holiday decorations, $150 for a party, and $300 for travel. Knowing these costs ahead of time allows you to allocate your resources wisely and prevent overspending in one area.

Have you ever?

Think back to a time when you planned a big family gathering, whether it was a holiday or another special occasion. You probably considered every detail, from the menu to the decorations.

By planning ahead, you ensured that the event was memorable for all the right reasons—and that you stayed within your budget.

.

In summary…

You deserve to enjoy the holidays without the financial worry.

.

.

.

Your takeaway…

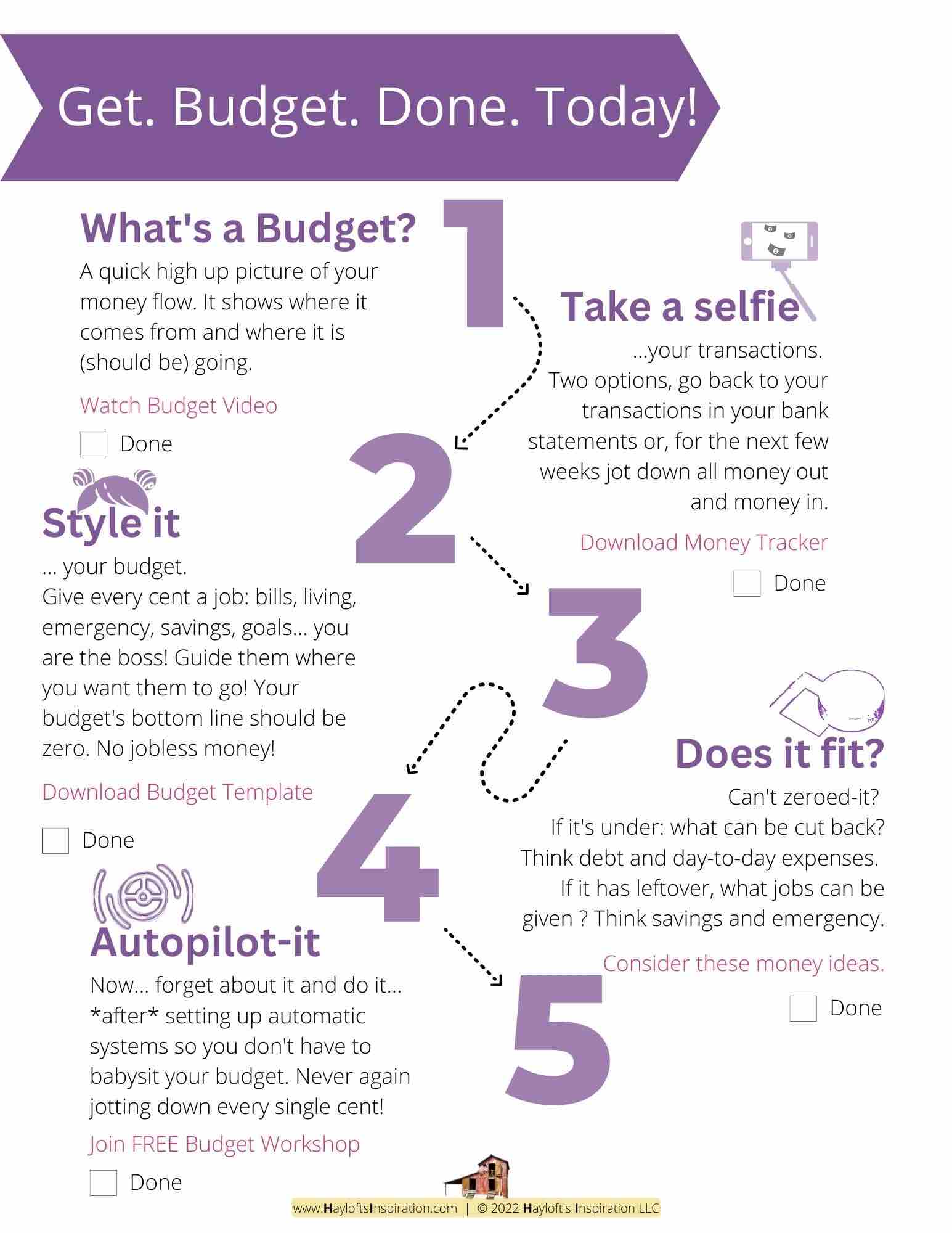

By setting a spending limit, making a gift list, and saving early, you’ll breeze through the holiday season with less stress and more joy. So why not start today? It is with a budget that you can realistically set that spending limit.

How else would you know that you might have more (financial) wiggle room than you think?

.

Now your turn. Share in the comments…

Now that you’ve got these tips in hand, it’s time to start planning your holiday budget. Trust me, you’ll thank yourself later.

May you share what are -or will try- your faves homemade DIY gifts?

For decades I have enjoyed making personalized Birthday cards. Way back in the day, I would send them via snail mail. Oh the times!

.

.

.

.

+ View comments

+ Leave a comment